Accounts from Incomplete Records

Meaning

Accounting records which are not maintained in accordance with the principles of double entry system are known as accounts from incomplete records or single entry system of accounting.

Features of Incomplete Records

- Unsystematic method

- Maintenance of personal accounts

- Maintenance of cash book

- No uniformity

- Dependence on original vouchers

- Less degree of accuracy

- Suitability

Advantages and Uses of Single Entry System

It is observed that many businessmen keep incomplete records because of the following reasons:

- Adequate knowledge of accounting principles not required

- Less expensive

- Less time consumed

- Convenient

- Suitable for small concerns

Limitations of Single Entry System

Limitations of single entry system are

- The arithmetical accuracy of accounts under single entry system cannot be ensured as trial balance cannot be prepared.

- Correct ascertainment and evaluation of financial results of business operations cannot be made.

- A problem in raising funds from outsiders and planning for future business activities may arise as analysis of profitability, liquidity and solvency of the business cannot be done.

- Filling of insurance claim with an insurance company by the owner in case of loss of inventory by fire or theft becomes difficult.

- Convincing the income tax authorities about the reliability of the computed income becomes difficult.

- Avoiding misappropriation of assets may become difficult as assets accounts are not maintained and it may be difficult to keep full control.

- Correct profit earned or loss incurred during the accounting period is not known as trading and profit and loss account cannot be prepared.

Profit Ascertainment/Statement of Profit or Loss under Single Entry System

Every business firm wishes to ascertain the results as operations to assess its efficiency, success and failure. This gives rise to the need for preparing the financial statements to disclose.

- The profit made or loss sustained by the firm due a given period.

- The amount of assets and liabilities as at the closing date of the accounting period.

This can be done in two ways:

- Preparing the statement of affairs as at the beginning and at the end of the accounting period called statement of affairs or net worth methods.

- Conversion method, i.e. by preparing trading the profit and loss account and the balance sheet putting the accounting records in proper order. Conversion method is not in syllabus. Therefore, it has been discussed.

Statement of Affairs or Net Worth Method

A statement of affairs is a statement of all assets and liabilities. It is a statement in which assets are shown on one side and the liabilities on the other, just as in case of a balance sheet. The difference between the totals of the two sides is the capital. Under this method, statement of assets and liabilities as at the beginning and at the end of the relevant accounting period is prepared, ascertain the amount of change in the capital during the period.

A statement of affairs is similar to, though not the same as a balance sheet.

Statement of Affairs (Format)

As at..

It is the total of liabilities side is deducted from the total of assets side of the statement of affairs, the balance will be taken as capital.

It is based on the accounting equation as

Capital = Assets – Liabilities

- Preparation of Statement of Profit or Loss

Once the amount of capital, both at the beginning and at the end is computed with the help of statement of affairs, a statement of profit or loss is prepared to ascertain the exact amount of profit or loss made during the year.

The difference between the opening and closing capital represents its increase or decrease which is to be adjusted for withdrawals made by the owner or any fresh capital introduced by him during the accounting period in order to arrive at the amount of profit or loss made during the period.

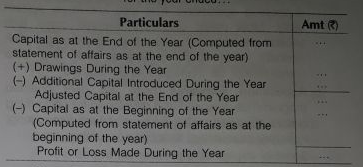

Statement of Profit or Loss (Format)

For the year ahead..

The same computation can be done in the form of an equation as follows:

Profit or Loss = Capital at the End – Capital at the Beginning + Drawings During the year – Capital Introduced During the year