Bills of Exchange

Meaning

According to Section 5 of the Negotiable Instruments Act, 1881, a bill of exchange is defined as an instrument in writing containing an unconditional order, signed by the maker directing a certain person to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument.

A bill of exchange is generally drawn by the creditor upon his debtor, It has to be accepted by the drawee (debtor) or someone on his behalf.

Features of a Bill of Exchange

- It must be in writing.

- It is an order to make payment.

- The order to make payment is unconditional.

- The maker of the bill of exchange must sign it.

- The payment to be made must be certain.

- The date on which payment is to be made must also be certain.

- It must be payable to a certain person.

- The amount mentioned in the bill of exchange is payable either on demand or on the expiry of a fixed period of time.

- It must be stamped as per the requirement of law.

- Parties to a Bill of Exchange

There are three parties to a bill of exchange:

- Drawer The maker of the bill of exchange is the drawer, i.e. the person who draws the bill. He is the person who has granted credit to the person on whom the bill of exchange is drawn.

- Drawee the person upon whom the bill of exchange is drawn for his acceptance is a drawee. Drawee is the person to whom credit has been granted.

- Payee he is the person to whom the payment is to be made, i.e. the person in whose favour the bill is made.

Advantages of a Bill of Exchange

- Framework of relationship

- Certainity of terms and conditions

- Convenient means of credit

- Conclusive proof

- Easy transferability

Types of a Bill of Exchange

There are two types of a bill of exchange:

- Trade Bill a trade bill is a bill of exchange drawn and accepted for a trade transaction, i.e. purchase and sale of goods.

- Accommodation bill an accommodation bill is a bill of exchange accepted for mutual help.

Promissory Note

According to Section 4, of the Negotiable Instruments Act, 1861, a promissory note is defined as an instrument in writing (not being a bank note or a currency note), containing an unconditional undertaking signed by the make, to pay a certain sum of money only to or to the instrument. A promissory note does not require any acceptance because the maker of the promissory note himself promises to make the payment.

Features of a Promissory Note

- It must be in writing.

- It must contain an unconditional promise to pay.

- The sum payable must be certain.

- It must be signed by the maker.

- It must be payable to a certain person. It should be properly stamped.

Parties to a Promissory Note

There are two parties to a promissory note:

- Maker or drawer the person who makes or draws the promissory note to pay a certain amount is called maker. He is the person who has availed the credit. He is also called the promisor.

- Payee the person in whose favour the promissory note is drawn, i.e. the person to whom the payment is to be made is called the payee. He is also called the promise.

Terms Related to Accounting of Bill of Exchange

Following are the important terms related to accounting of bills of exchange:

- Term of a bill is referred to as the period the date on which a bill is drawn and the date on which it becomes due.

- Days of grace are three extra days added to the period of bill.

- Due date of a bill it is the date on which the payment of the bill is due, i.e. the date on which the term of bill expires.

- Date of maturity of a bill the date which comes after adding three days of grace to the due date of a bill is called the date of maturity.

- Bill at sight or demand the instruments in which no time for payment is mentioned are known as bill at sight. These are also known as instruments payable on demand.

A bill of exchange or promissory note is payable on demand, when no time for payment is specified, where it is expressed to be payable on demand or at sight on presentment.

- Bill after date the instrument in which time for payment is mentioned are bill after sight.

A Promissory note or bill of exchange is a time instrument when it is expressed to be a payable after specified period, on a specific day, after sight, on the happening of event which is certain to happen.

- Holder of a negotiable instrument (i.e. bill of exchange promissory note or cheque) is a person entitled in his own name to be possession thereof and to receive or recover the amount due thereon from the parties to it.

Calculation of Due Date of a Bill

The calculation of due date of a bill in various cases is calculated as follows:

| Cases | Due Date |

| When the bill is made payable on a specific date. | The specific date will be the due date. |

| When the bill is made payable at a stated number of month(s) after date. | That date on which the term of the bill shall expire will be the due date Calculation of due date will be in terms of calendar months, ignore the number of days in a month. |

| When the bill is made payable at a stated number of days after date. | That date which comes after adding stated number of days to the date of bill, shall be the due date. The date of bill is excluded. |

| When the due date is a public holiday. | The preceding business day will be the due date. |

| When the due date is an emergency/unforeseen holiday. | The next following day will be the due date. |

Calculation of the Date of Maturity in Case of Time Bills

To arrive at the date of maturity in case of time bills, three days of grace are added to the due date. This can be better explained with the help of examples given below.

When the bill is made payable at a stated number of days after date

A Bill dated 1st January 2013 is payable after 60 days after date.

The date of maturity will be 5th March, 2013

[30 days of January + 28 days of February + 2 days of March + 3 days of grace]

When the bill is made payable at a stated number of months after date

A bill dated 1st January, 2013 is payable 3 months after date.

The date of maturity will be 4th April, 2013

[3 months from 1st January, 2013 is 1st April, 2013 adding 3 days of grace, the due date will be 4th April, 2013]

When the maturity date falls on a day which is a public holiday

Suppose the date of maturity is 15th August, 2013 (Independence Day) it being a public holiday, it falls due on 14th August, 2013.

When the maturity date falls on a day which is an emergency/unforeseen holiday

Suppose the date of maturity falls on an unforeseen holiday, then the next working day will be taken as the date of maturity.

Accounting Treatment of Bills of Exchange and Promissory Note

- When the bill is retained till the date of maturity

When the drawer retains the bill with him till the date of its maturity, the drawer receives the money from the drawee on the maturity date.

Journal Entries

Sometimes, the bill is sent to the bank with instruction that the bill should be retained till maturity and realized on its due date, i.e. the bank should keep the bill till maturity and collect is amount from the acceptor on that date, it is known as ‘bill sent for collection’. The bank credits the net proceed to the customer’s account, after charging for the service. The balance in the bills sent for collection account is shown in the balance sheet as an asset.

Journal Entries

- When the bill is discounted with bank

In case, a holder of the bill is in need of money, he may discount it through the bank, to obtain cash, i.e. the holder of the bill takes amount from a bank against the bill before the due date. This process is known as discounting of the bill. The bank charges an amount for this purpose and it is termed as ‘discounting charges’.

The charges depend upon the rate of interest and the period of maturity. It is be noted, discounting charges are calculated on the remaining period of the bill, i.e. from the date of discounting till the due date. The bank gets the amount from the drawee on the due date.

Journal Entries

Transfer of a bill of exchange or promissory note to another person is referred to as endorsement negotiation. The person receiving it becomes entitled to receive the payment. The bill can be internal endorsed by the drawer by putting his signature at the back of the bill along with the name of the panty,

Whom it is being transferred. The act of signing and transferring the bill is called endorsement.

A Bill is said to have been negotiated or endorsed, when the holder of a bill transfers the bill to a third party. The person who endorses the bill is called the endorser. The person to whom the bill is endorsed is called endorsee.

Journal Entries

Dishonour of a bill

When the drawee or acceptor of the bill fails or is unable to make the payment on the date of maturity, a bill is said to have been dishonored. The holder of the bill may present the bill through a notary public. A bill get the dishonor of the bill noted. Noting authenticated the fact of dishonour , for providing this services fess is charged by notary public which is called nothing charges.

The entries recorded for noting charges in the drawer’s book as follows:

In the Books of Drawer

Note:It may be noticed that whosever pays the nothing charges. Ultimately these have to be borne by the drawee. This is because he is responsible for the dishonour of the bill and hence, he has to bear these expenses. For recording the noting charges in his books, the drawee opens noting charges account. He debits the noting charges account and credits the drawer’s account.

Journal Entries on Dishonour of Bill

In the Books of Drawer

In the books of drawee

Bills Payable A/C Dr

Noting Charges A/C Dr

To Drawer’s A/c

(Being the amount of dishonour bill and noting charges credited to the drawer)

Note:When the bill is dishonoured, in all the circumstances drawee or acceptor account is debited when entries are passed in the books of drawer and drawer’s and drawer’s account is always credited and bills payable account is always debited, when entries are passed in the books of drawee.

- Renew of the bill

When the acceptor of the bill is difficult to meet the obligation of the bill on maturity he may request the drawer for extension of time for payment (i.e. to substitute the old bill when a new bill), if the drawer agrees the old bill cancelled and the fresh bill with new terms of payment is drawn and duty accepted and delivered. This is termed as renewal of bill.

The noting of the bill is not required as the cancellation is mutually agreed. However, the drawer may charges interest from the drawee for the extended period of credit.

Journal Entries

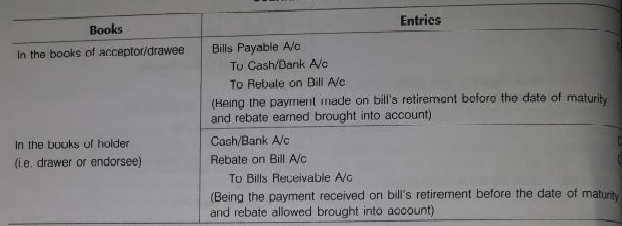

- Retiring of the bill under rebate

When the drawee makes the payment before the date of maturity, a bill is said to be referred or retiring of a bill. In such case, the holder of the bill allows some discount called rebate on bills to the drawee. For the holder of the bill, rebate is a loss and for the acceptor, it is a gain.

Journal Entries

- Accommodation Bill

Bills of exchange are usually drawn to facilitate trade transactions. That is to say bills of exchange are meant finance actual purchase and sale of goods and these are known as trade bills.

Apart from financing transactions in goods, bills of exchange, promissory notes may also be used for raised funds temporarily.

Such a bill is called an ‘accommodation bill’ as it is accepted by the drawee to accommodate the drawer. Hence, the drawer is called the ‘accommodating party’ and the drawer is called the accommodation party.

When the accommodation parties agree to raise the funds through an accommodation bill for mutual benefits. It can be done in any of the following two ways:

- The drawer and the drawee share the proceeds in an agreed ratio.

- Each draw a bill and each accepts a bill.

In the first case, the discounting charges are shared by drawer and drawee in the ratio in which they share to proceeds. But in the second case, the discount is not shared as each party retains the entire proceeds of the drawn and discounted by him. On maturity, each party meets his acceptance.

Accounting treatment of accommodation billEntries are made in the same manner as are made for on bills, no special entries are passed for accommodation bills. Also, in case, the proceeds of the bills are shared an entry for the proportionate amount of discount along with the entry for remittance.