Journal and Ledger

- Rules of Debit and Credit

Debit (Dr) means to enter an amount of transaction on the left side of an account and credit (Cr) means to enter an amount on the side of an account. Depending on the nature of account, both debit and credit may represent increase or decrease.

Rules for debit and credit according to traditional classification (i.e. personal, real and nominal)

| Types of Accounts | Rules for Debit | Rules for Credit |

| Personal Accounts | Debit the receiver | Credit the giver |

| Real Accounts | Debit what comes in | Credit what goes out |

| Nominal Accounts | Debit all expenses and losses | Credit all incomes and gains |

Rules for debit and credit according to modern classification or accounting equation based classification

| Types of Accounts | Types of Accounts | Rules for Credit |

| Assets Accounts | Debit the increase | Credit the decrease |

| Liabilities Accounts | Debit the decrease | Credit the increase |

| Capital Accounts | Debit the decrease | Credit the increase |

| Revenue Accounts | Debit the decrease | Credit the increase |

| Expenses Accounts | Debit the increase | Credit the decrease |

- Book of Original Entry (Journal)

Journal is the book of original entry or prime entry. Journal is a book in which transaction are recorded in the order in which they occur, i.e. in chronological order. The process of recording a transaction in a journal is called journalizing. An entry mode in the journal is called a journal entry.

- Format of a Journal

Journal

| Date

(1) |

Particulars

(2) |

LF

(3) |

Amt (Dr)

(4) |

Amt (Cr)

(5) |

- Simple and Compound Journal Entries

The journal entry is the basic record of a business transaction. It may be simple or compound.

- Simple entry when only two accounts are involved to record a transaction, it is called a simple journal entry. In this one account is debited and another account is credit with an equal amount.

- Compound entry when the number of accounts to be debited and credit is more than one, entry made for recording the transaction is called compound journal entry. In other words, it involves multiple accounts.

- Recording in Journal

Entries are recorded in journal on the basis of source documents following the rules of debit and credit.

A Quick Glance of Some Important Journal Entries

| Transactions | Journal Entry |

| Cash brought into the business as capital | Cash/Bank A/C Dr

To Capital A/C |

| Cash and other assets brought into business | Building A/c Dr

Plant and Machinery/Furniture A/c Dr Cash A/c Dr To Capital A/c |

| Goods purchased on cash | Purchases A/c Dr

To Cash/Bank A/C |

| Goods purchased on credit | Purchases A/c Dr

To Supplier’s A/c |

| Cash Sales | Cash A/c Dr

To Sales A/c |

| Sales of goods on Credit | Customer A/c Dr

To Sales A/c |

| Opening a bank account | Bank A/c Dr

To Cash A/c |

| Purchase of assets for cash | Assets A/c Dr

To Cash/Bank A/c |

| Sale or disposal of any old asset at loss | Cash/Bank A/c Dr

Loss on Sale of Assets A/c To Asset A/c |

| Sale or disposal of any old asset at profit | Cash/Bank A/c Dr

To Loss on Sale of Assets A/c To Asset A/c |

| Cash withdrawn for personal use | Drawings A/c Dr

To Cash A/c |

| Goods withdrawn for personal use | Drawings A/c Dr

To Purchase A/c |

| Goods given as Charity | Charity A/c Dr

To Purchase A/c |

| Goods returned by the customer | Return Inwards A/c Dr

To Customer A/c |

| Goods returned to the supplier | Supplier’s A/c Dr

To Return Outwards A/c |

| Withdrawn of cash from bank | Cash A/c (Office Use) Dr

Drawings A/c (Personal Use) Dr To /Bank A/c |

- Balancing of Single Column Cash Book

The cash book is balanced in the same way as an account in the ledger. On the left side, all cash transaction relating to cash receipts (debits) and on the right side all transactions relating the cash payments (credits) and entered date wise. When a cash book is maintained, a separate cash account in the ledger is not opened.

- Ledger Posting from Single Column Cash Book

Posting of debit side and credit side of cash book is carried out as follows:

Debit Side The left side or debit side of the cash book shows the receipts of the cash. The account appears on the debit side of the cash book are credited to their respective ledger accounts by written ‘By Cash’ in the particulars column because cash has been received in respect of them.

Credit Side The right side or credit side of the cash book shows all the payments made in cash. The accounts appearing on the credit side of the cash book are debited to the ledger accounts by entering ‘To Cash’ in the particulars column as cash/cheque has been paid in respect of them.

- Two-Column or Double Column Cash Book (Cash Book with Discount Column)

Two-Column cash book is a cash book which has two columns on each side of the cash book. One for cash and anotherfor discount (allowed and received).

Format of Two-Column Cash Book

Two-Column Cash Book

Dr Cr

| Date | Particulars | LF | Discount

(Rs.) |

Cash

(Rs.) |

Date | Particulars | Lf | Discount

(Rs.) |

Cash

(Rs.) |

↓ ↓

Receipts Payments

- Balancing of Two-Column Cash Book

Cash Columns are balanced in the same manner as in the case of single column cash book. Discount columns are not balanced but are totaled. Amount in the discount column on the side is the amount allowed as cash discount, it is an expenses for the business and amount in the discount column on the credit side is the amount received as cash discount on the payments made, it is an income for the business.

- Ledger Posting from Double Column Cash Book

Cash Column The process of posting of entries in the cash column is same as in case of single column cash book.

Discount Column on each side is separately totaled. Total of discount column on debit side, i.e. receipt side is posted to the debit of discount allowed account, as it is an expense for the business and total of discount column on credit side, i.e. payment side is posted to the credit of discount received account as is an income for the business.

- Three-column or Triple-column Cash Book (Cash Book with Bank and Discount Column)

Three-Column cash book is a cash book which has three columns on each side. One for cash, one for bank and one for discount. In other words, it can be said that three-column cash book represents two accounts, i.e. cash account and bank account. Hence, there is no need to open these accounts in the ledger.

As cash and bank accounts are both asset account therefore cash and bank transactions are recoded in the cash and bank column respectively, following the rule debit the increase in asset and credit the decrease in asset. All the cash receipts, deposits into the bank and discount allowed are recorded on debit side and all cash payments, withdrawals from bank and discount received are recorded on credit side.

Format of Two-Column Cash Book

Two-Column Cash Book

Dr Cr

| Date | Particulars | LF | Discount

(Rs.) |

Cash

(Rs.) |

Bank

(Rs.) |

Date | Particulars | Lf | Discount

(Rs.) |

Cash

(Rs.) |

Bank

(Rs.) |

↓ ↓

Receipts Payments

- Balancing of Three-column Cash Book

Cash columns are balanced in the same manner as in case of single column cash book. The process for balancing the bank column is also the same.

However, it is possible that the bank allows the firm to withdraw more than the balance (the amount deposited), i.e. overdraft.

- Ledger Posting of Three-column Cash Book

Posting of debit side and credit side of cash book is carried out as follows:

Debit Side the left side or debit side of the cash book shows the receipt of cash. Transactions written in the cash and bank column on debit side are credited to their respective ledger account by written ‘By Cash’ (for cash transactions) and ‘By Bank’ (for bank transactions) in the particulars column. ‘Amount Column’ records the amount of the transaction.

Discount allowed is individually posted to the credit of related account. Total of discount column is posted to the debit of discount allowed account.

Credit Side The right side or credit side of the cash book shows all the payments made in cash.

Transactions written in cash and bank column or credit side are debited to their respective ledger accounts by written ‘To Cash’ (for cash transactions) and ‘To Bank’ (for bank transactions) in the ‘Particulars Column’ records the amount of transaction.

Discount received individually is posted to the debit of related account. Total of the discount column is posted to the credit of discount received account.

- Petty Cash Book

Petty Cash Book is the book which is used for the purpose of recording the payment of petty cash expenses.

Petty Cash Book is prepared by petty cashier to record petty expenses (of small amounts). This book is prepared to save valuable time of main (head) cashier from bothering about small and irrelevant cash expenses. For transferring cash to petty cash account, cash account is credited and petty cash account is debited.

- Format of Petty Cash Book

The format of petty cash book may be designed according to the requirements of the business. However, the simplest format is given:

- Balancing the Pretty Cash Book

Petty cash book is balanced in the same manner as a simple cash book. The columns for payments and expenses are totaled and the total equals in the ‘total payment column’. A petty cash book is balanced at the end of the month or a specified period.

- Posting the Petty Cash Book

- Entries in the petty cash book are posted into the ledger accounts at the end of the specified period, i.e. monthly or quarterly or as the cash may be.

- Petty cash book is not posted directly in the ledger. For posting the petty cash book. A petty cash account is opened in the ledger.

- When petty cash is advanced to the petty cashier, it is recorded by the chief cashier on the credit side as ‘By petty cash A/c’.

- At the end of specified period, a journal entry is first prepared on the basis of the petty cash book, debiting each expenses account individually as per the total shown by respective column and crediting the petty cash account with the total expenditure incurred during the period. Thereafter, posting is made to the debit of each expenses account by written ‘To Petty Cash A/c’.

- Purchase Book or Purchase Journal

Purchase journal records all credit purchases of goods (i.e. goods in which the enterprise deals in). Cash purchases and purchases of goods other than goods in which the firm deals, are not recorded in purchases journal or book.

The source documents for recording entries in the books are invoices or bills received by the firm from the suppliers of the goods with the amounts net of trade discount/quantity discount. Purchase book is also known as invoice book/bought book.

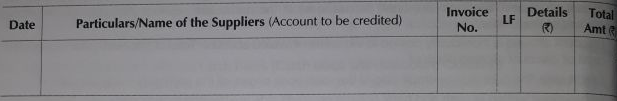

- Format of a Purchases Book

Purchases Book

- Ledger Posting of Purchases Book

The individual entries and the total of the purchases book are posted into the ledger as follows:

- Individual amounts are daily posted to the credit of supplier’s accounts by written ‘By Purchases A/c’ in the particulars column.

- Periodic total is posted to the debit of purchases amount by written ‘To sundries as per purchases book’ in the particulars column.

- Sales Book for Sales Journal

Sales book records all credit sale of merchandise (i.e. the goods in which the firm deals in). It does not record the cash sales or merchandise or any other asset other than the merchandise. The source documents recording entries in the sales journal are sales invoice or bill issued by the firm to the customers with the net trade discount/quality discount. It is also known as day book.

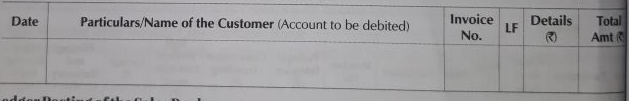

- Format of a Sales Book

Sales Book

- Ledger posting of the Sales Book

The individual entries and the total of the sales book are posted into the ledger as follows:

- Individual amounts are daily posted to the debit of customer’s accounts by written ‘To Sales A/c’ in the particulars column.

- Periodic total is posted to the credit of sales account by writing ‘By Sundries as per Sales Book’ in the particulars column.

- Purchase Return or Return Outwards Book

In this book, purchase returns of goods are recorded. It does not record the returns of goods purchased on cash basis not the returns of purchases other than the goods in which the firm deals in. The entries are usually made the particulars return book on the basis of debit notes issues to the suppliers and credit notes received from the suppliers.

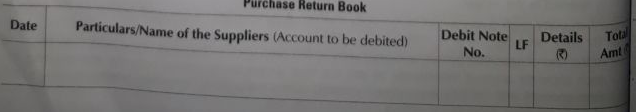

- Format of a Purchases Return Book

Purchase Return Book

- Ledger Posting of a Purchase Return Book

The individual entries and the total of the book are posted into the ledger as follows:

- Individual amounts are debited to the supplier’s account by written ‘To Purchase Return A/c’ in the particulars column.

- Periodic total is credited to the purchase return account by written ‘By Sundries as per Purchase Return Book’ in the particulars column.

- Sales Return or Return Inwards Book

This journal is used to record return of goods by customers that had been sold on credit. It does not record the return of goods sold on cash basis not the return of any asset other than the goods in which the firm deals in. The source documents for recording entries in the sales return journal are the credit notes issues to the customers or debit notes issued by the customers.

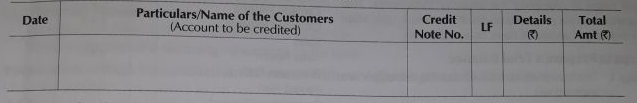

- Format of sales Return Book

Sales Return Book

- Ledger Posting from Sales Return Book

The individual entries and the total of the book are posted into the ledger as follows:

- Individual amounts are credited to the customer’s accounts by written ‘By Sales Return A/c’ in the particulars column.

- Periodic total is debited to the sales returns accounts by written ‘To Sundries as per Sales Return Book’ in the particulars column.

- Journal Proper

A Book maintained to record transactions which do not find place in special journals, is known as journal proper or journal residual. In other words, journal proper records transactions which cannot be recorded in any other subsidiary book such as cash book, purchase book, sales book, purchase return book, sales return book.

Following transactions are recorded in journal proper:

- Opening Entries

- Closing Entries

- Adjustment Entries

- Rectification Entries

- Transfer Entries

- Other Entries in addition to the above mentioned entries, recording of the following transactions is also done in the journal proper.

- At the time of dishonor of a cheque, the entry for cancellation for discount received or discount allowed earlier.

- Purchase/Sale of items on credit other than goods.

- Goods withdrawn by the owner for personal use.

- Goods distributed as samples for sales promotion.

- Endorsement and dishonor of bills of exchange.

- Transaction in respect of consignment and joint venture, etc.

- Loss of goods by fire/theft/spoilage.