UNIT 10

Introduction :

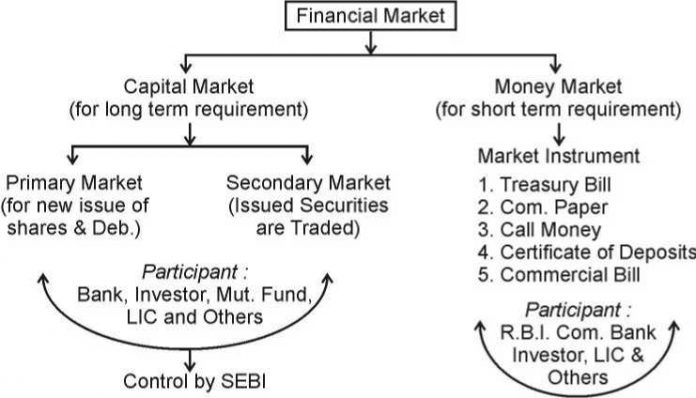

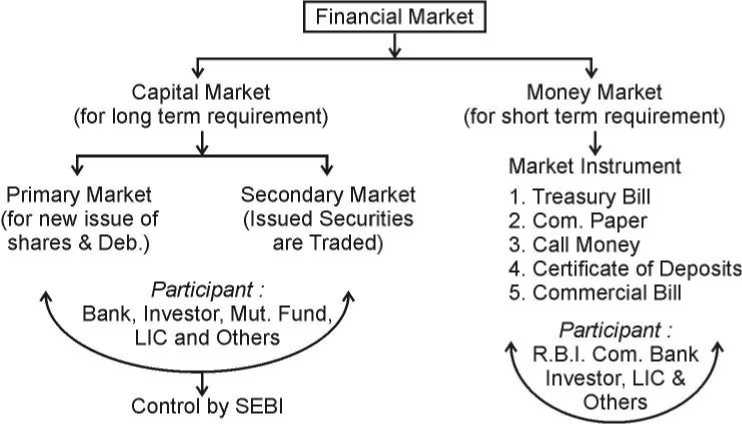

Financial Market is a market for creation and exchange of financial assets like share, bonds etc. It helps in mobilising savings and channelising them into the most productive uses. It helps to link the savers and the investors by mobilizing funds between them. The person / Institution by which allocation of funds is done is called financial intermediaries.

Functions of Financial Market.

- Mobilisation of Savings and channeling them into the most productive

uses: Financial market facilitates the transfer of savings from savers to investors and thus helps to channelise surplus funds into the most productive use.

- Help in Price Determination : Financial Market helps in interaction of savers and investors which in turn helps in the determination of prices of the financial assets such as shares, debentures etc.

- Provide Liquidity to Financial Assets : Financial market ficilitate easy purchase and sale of financial assets. Thus, it provide liquidity to them so that they can be easily converted into cash whenever required.

- Reduce cost of transactions : Financial market provide valuable information about securities which helps in saving time, efforts and money and thus it reduces cost of transactions.

Money Market

It is a market for short term funds / securities whose period of maturity is upto one year. The major participants in the money market are RBI, Commercial Banks, Non-Banking Finance Companies, State Government, Large Corporate Houses and Mutual Funds. The main instruments of money market are as follows.

- Treasury Bills : They are issued by the RBI on behalf of the Central Government to meet its short-term requirement of funds. They are issued at a price which is lower than their face value and repaid at par. They are available for a minimum amount of Rs. 25,000 and in multiples thereof. They are also known as Zero Coupon Bonds.

- Commercial Paper : It is a short term unsecured promisory note issued by large and credit worthy companies to raise short term funds at lower rates of interest than market rates. They are negotiable instrument transferable by endorsement and delivery with a fixed maturity period of 15 days to one year.

- Call Money : It is short term finance repayable on demand, with a maturity period of one day to 15 days, used for interbank trasactions. Call Money is a method by which banks borrow from each other to be able to maintain the cash reserve ratio as per RBI. The interest rate paid on call money loans is known as the call rate.

- Certificate of Deposit : It is an unsecured instrument issued in bearer form by Commercial Banks & Financial institutions. They can be issued to

individuals, Corporations and companies for raising money for a short period ranging from 91 days to one year.

5. Commercial Bill : It is a bill of exchange used to finance the working capital requirements of business firms. A seller of the goods draws the bill on the buyer when goods are sold on credit. When the bill is accepted by the buyers it becomes a marketable instrument and is called a trade bill. These bills can be discounted with a bank if the seller needs funds before the bill maturity.

Capital Market :

It is a market for long term funds where debt and equity are traded. It consists of development banks, commercial banks and stock exchanges. The capital market can be divided into two part.

- Primary Market.

- Secondary Market

Primary Market :

It deals wth the new securities which are issued for the first time. It is also known as the new issues market. The investors in this market are banks, financial institutions, insurance companies, mutual funds and individuals. It has no fixed geographical location and only buying of securities take place in the primary market.

Secondary Market :

It is also known as the stock market or stock exchange where purchase and sale of existing securities take place. They are located at specified places and both the buying as well as selling of securities take place.

Methods of flotation of New Issues in the Primary Market

- Offer through Prospectus : It involves inviting subscription from the public through issue of prospectus. A prospectus makes a direct appeal to investors to raise capital through an advertisement in newspapers and magazines.

- Offer for sale : Under this method securities are offered for sale through intermediaries like issuing houses or stock brokers. The company sells securities to intermediary / broker at an agreed price and the broker resell them to investors at a higher price.

|

3. |

Private Placements : It refers to the process in which securities are allotted to institutional investor and some selected individuals. |

||

|

4. |

Rights Issue : It refers to the issue in which new shares are offered to the existing shareholders in proportion to the number of shares they already possess. |

||

|

5. |

e-IPOs :- It is a method of issuing securities through on-line system of stock exchange. A company proposing to issue capital to the public through the on-line system of the stock exchange has to enter into an agreement with the stock exchange. This is called an e-initial public offer. SEBI registered brokers have to be appointed for the purpose of accepting applications and placing orders with the company. |

||

|

Difference between Capital and Money Market. |

|||

|

Basis |

Capital Market |

Money Market |

|

|

1. |

Participants |

Financial Institutions, Banks Corporate Entities, foreign investors and individuals |

RBI, Banks, Financial Institutions & finance companies |

|

2. |

Instruments Traded |

Equity shares, bonds preference shares and debentures |

Treasury Bills, trade bills, commercial paper, call money etc. |

|

3. |

Investment outlay |

Does not necessarily require a huge financial outlay |

Entail huge sums of money as the instruments are quite expensive. |

|

4. |

Duration |

Deals in medium & long term securities having maturity period of over one year. |

Deals in short term funds having maturity period upto one year. |

|

5. |

Liquidity |

Securities are less liquid as compared to money market securities. |

Money market instruments are highly liquid. |

|

6. |

Expected Return |

High return |

Low return |

|

7. |

Safety |

Capital Market instruments are riskier both with respect to return and repayment. |

Money market instrument are generally much safer with a minimum risk of default. |

|

73 |

XII – Business Studies |

||

Difference between Primary and Secondary Market

Basis

- Securities

- Price of Securities

- Purchase & Sale.

- Place of Market

- Medium

Primary Market

Only new Securities are traded.

Prices of securities are determined by the management of the company.

Securities are sold to investors directly by the company or through intermediary.

There is no fixed geographical location

Only buying of securities takes place

Secondary Market

Existing securities are traded.

Price are determined by the forces of demand and supply of the securities.

Investors exchange ownership of securities.

Located at specified places.

Both buying & the selling of securities can take place.

Stock Exchange / Share Markets

A stock Exchange is an institution which provides a platform for buying and selling of existing securities. It facilitates the exchange of a security i.e. share, debenture etc. into money and vice versa. Following are some of the important functions of a stock Exchange.

- Providing liquidity and Marketability to Existing Securities : Stock Exchange provide a ready and continuous market for the sale and purchase of securities.

- Pricing of Securities : Stock Exchange helps in constant valuation of securities which provide instant information to both buyers and sellers and thus helps in pricing of securities which is based on the forces of demand & supply.

- Safety of transaction : The members of a stock exchange are well regulated, who are required to work within the legal framework. This ensures safety of transactions.

- Contributes to Economic Growth : Stock exchange provide a platform by which saving get channelised into the most productive investment proposals, which leads to capital formation & economic growth.

- Spreading of Equity cult : Stock exchange helps in educating public about investments in securities which leads to spreading of Equity culture.

6. Providing scope for speculation : Stock exchange provides scope within the provisions of law for speculation in a restricted and controlled manner.

Trading Procedure on a Stock Exchanges.

- Selection of Broker : In order to trade on a stock Exchange first a broker is selected who should be a member of stock exchange as they can only trade on the stock exchange.

- Placing the order : After selecting a broker, the investors specify the type and number of securities they want to buy or sell.

- Executing the order : The broker will buy or sell the securities as per the instructions of the investor.

- Settlement : Transactions on a stock exchange may be carried out on either cash basis or a carry over basis (i.e. badla). The time period for which the transactions are carried forward is referred to as accounts which vary from a fortnight to a month. All transactions made during one account are to be settled by payment for purchases and by delivery of share certificates, which is a proof of ownership of securities by an individual.

Earlier trading on a stock exchange took place through a public outcry or aution system which is non replaced by an online screen based electronic trading system. Moreover, to eliminate, the problems of theft, forgery, transfer delays etc an electronic book entry from a holding and transferring securities has been introduced, which is called process of dematerialisation of securities.

National Stock Exchange of India (NSE)

NSE was set up by leading financial institutions, banks, insurance companies and other financial intermediaries in 1992 and was recognised as a stock exchange in April 1993. It has provided a nation wide screen based automated trading system with a high degree of transparency and equal access to investors irrespective of geographical location. NSE was set up with the following objectives.

- Establishing a nation-wide trading facility for all types of securities.

- Ensuring equal access to investors all over the country through an appropriate communication network.

- Enabling shorter settlement cycles and book entry settlements.

- Providing a fair, efficient and transparent securities market using electronic trading system.

- Meeting international bench marks & standards.

NSE provides trading in following two segments :

- Whole sale Debt Market Segment which provide platform for a wide range of fixed income securities such as Government Securities, treasury bills, state development loans, PSU bonds etc.

- Capital Market Segment which provide platform for equity shares, preference shares, debentures etc. as well as retail Govt. securities.

Over the Counter Exchange of India (OTCEI)

OTCEI was promoted by UTI, ICICI, IDBI, IFCI, LIC, GIC, SBI Capital Markets and can Bank Financial Services. It is a place where buyers seek sellers and vice-versa and then attempt to arrange terms and conditions for purchase / sale acceptable to both the parties. It is fully computerised, transparent, single window exchange which provide quicker liquidity to securities at a fixed and fair price, liquidity for less traded securities. Following are the advantages of OTC Market.

- It provides a trading platform to smaller and less liquid companies.

- It is a transparent system of trading with no problem of bad or short deliveries.

- Family concerns & closely held companies can go public through OTC.

- Dealer can operate both in new issues & secondary market at their options.

- It is cost effective as there is a lower cost of new issues and lower expenses of servicing the investors.

Difference beteen NSEI and OTCEI

|

Basis |

NSEI |

|

|

1. |

Establishment |

1992 |

|

2. |

Settlement |

within 15 days |

|

3. |

Security |

In whole sale debt |

|

Traded |

Market segment Treasury |

OTCEI

1990

within 7 days Equity, debentures etc.

bill, PSU Bonds etc & In Capital Market segment equity shares, preference shares, debentures

4. Objectives To provide nation

wide, ringless transparent trading facility for all instruments.

To serve as an exchange for securities of small companies.

5. Size of the Paid up capital Paid up capital

company Rs. 3 Crore & above Rs. 30 Lakh & above.

Depository Services and D mat Accounts :

Keeping in the mind the difficulties to transfer of shares in physical form SEBI has developed a new system in which trading in shares is made compulsory in electronic form Depository services and D Mat Account are very basis of this system.

Depository Services :

Now a days on line paper-less trading in shares of the company is compulsory in India. Depository services is the name of that mechanism. In this system transfer of ownership in shares take place by means of book entry without the physical delivery of shares. When a investor wants to deal in shares of any company he has to open a D Mat account. There are four players who participate in this system.

- The Depository : A depository is an institution which hold the shares of an investor in electronic form. There are two depository institution in India these are NSDL and CDSL.

- The Depository Participant : He opens the Account of Investor and maintains securities records.

- The Investor : He is a person who wants to deal in shares whose name in recorded.

- The Issuing Company : That organisation which issue the securities. This issuing company send a list of the shareholders to the depositories.

D Mat Accounts :

In this process a shares certificates converted its physical form to electronic form and credited the same number of holding to D mat A/c.

Benefits of D Mat Account :

- Reduces of paper work.

- Elimination of problems on transfer of shares such as loss, theft and delay.

- Exemption of stamp duty when transfer of shares.

- The concept of odd lot stand abolished.

- Increase liquidity through speedy settlement.

- Attract foreign investors and promoting foreign investment

Depository System Parallel to Banking System

The depository system in parallel to the Banking System. A bank holds cash in account the depository hold shares in account. The transfer of cash and shares take place with-out the physical handling of cash or shares.

Securities and Exchange Board of India (SEBI)

SEBI was established by Government of India on 12 April 1988 as an interim administrative body to promote orderly and healthy growth of securities market and for investor protection. It was given a statutory status on 30 January 1992 through an ordinance, which was later replaced by an Act of Parliament known as the SEBI Act, 1992.

Objectives of SEBI

- To regulate stock exchange and the securities market to promote their orderly functioning.

- To protect the rights and interests of investors and to guide & educate them.

- To prevent trade malpractices such as internal trading.

- To regulate and develop a code of conduct and fair practices by intermediaries like brokers, merchant bankers etc.

Function of SEBI

Regulatory Functions

- Framing Rule & Regulations

- Registrations of broker & sub-brokers

- Registration of collective investment schemes & mutual funds.

- Regulation of Stock Brokers, portfolio exchanges, underwriters & Merchant Bankers

- Regulation of task over bids by companies.

- Levying fee or other charges as per Act.

1.

2.

3.

4.

5.

Development Functions

Training of intermediaries Conducting Research & Publishing useful information.

Undertaking measures to develop capital market by adapting flexible approach. Educating Investors to broader their understanding Permitting internet trading through registered stock brokers

Protective Functions

- Prohibiting of frandulent & unfair trade practices.

- Check on insider trading.

- Ensure investors protection.

- Promote fair practice & code of conduct in securities market.

- Check on price rigging.

- Check on preferential allotment.

|

One Marks Questions : |

||

|

1. |

What is the maturity period of a commercial Paper? |

|

|

2. |

What is a Treasury Bill? |

|

|

3. |

AB Ltd. has sold 1 lakh equity shares of Rs. 10 each at Rs. 12 per |

share |

|

to an investment banker, who offered them to the public at Rs. 20 Identify the method of flotation. |

each. |

|

|

4. |

State any two instruments of Capital Market. |

|

|

5. |

Who act as the watchdog of Security Market in India? |

|

|

6. |

Who is the Borrowers of call money? |

|

|

7. |

What is the other name of Zero coupon Bodn? |

|

|

8. |

Who issues the treasury Bill? |

|

|

9. |

What is the other name of Primary Market? |

|

|

10. |

What is a Prospectus? |

|

|

11. |

What is Dematerialization? |

|

|

12. |

What is the minimum amount of Treasury Bill? |

|

|

13. |

What is D Mat A/c? |

|

|

14. |

Write one benefit of D Mat Account? |

|

|

Three / Four Marks Questions |

||

|

1. |

State the various protective functions of SEBI. |

|

|

2. |

What is money market? Explain its three instruments. |

|

|

3. |

What is meant by commercial paper & certificate of Deposit? |

|

|

4. |

Distinguish between NSEI and OTCEI on following basis.

|

|

|

5. |

State any four regulatory functions of the SEBI. |

|

|

6. |

Make difference between Primary and Secodary Market. |

|

|

79 XII – Business Studies |

||

Five/ Size marks Questions.

- Explain any five / six functions of stock exchange.

- Why was SEBI set up? State its development functions.

- Explain any five methods of floating new issues in the primary market.

- Explain the trading procedure on a stock exchange.

- Distinguish between capital market and money market on the following

|

basis. |

|

|

a) |

Participants |

|

b) |

Instruments Traded. |

|

c) |

Duration of Securities Traded. |

|

d) |

Expected Return |

|

e) |

Safety |

|

f) |

Liquidity. |

- Primary Market contribute to capital formation directly Secondary Market does so indirectly Explain.

- You are finance expert. Your father feels that there is no difference between Primary Market and Secondary Market. Where do you differ with him. How would you convince him. Give reasons in support of your answer.

- What are the benefits of depository services and D Mat Account.

- Explain the constituents of depositry services.

- Mohan wants to sell 50 shares of Tata Motor. Explain the trading procedure of shares.