Trial Balance

- Meaning

Trial balance is a statement prepared with the debit and credit balances of ledger accounts to test the arithmetical accuracy of the books.

- Objectives, Needs or Functions of Preparing a Trial Balance

- Ascertain the arithmetical accuracy of the ledger accounts

- Helps in locating errors

- Summary of the ledger accounts

- Helps in the preparation of final accounts

- Balance Method of Preparing Trial Balance

Balance method is the most commonly used method of preparing trial balance as it facilities the preparation of final accounts. Under this method, trial balance is prepared by showing the balances of all ledger accounts (including cash and bank accounts) and then totaling up the debit and credit column of the trial balance to assure their correctness. The account balances are used because the balance summaries the net effect of all transactions relating to an account and helps in preparing the financial statements. Trial balance can be prepared under this method, only when all the ledger accounts have been balanced.

- Steps to Prepared a Trial Balance

Step 1 The balances of each account in the ledger are ascertained.

Step 2 List each account and place its balance in the debit or credit column (if an account has a zero balance, it may be included in the trial balance with zero in the column for its normal balance).

Step 3 Compute the total of debit balances column.

Step 4 Compute the total of debit balances column.

Step 5 Verify that the sum of the debit balances equal the sum of credit balances. If they do not tally, it indicates that there are some errors. So, one must check the correctness of the balances of all accounts.

- Format of Trial Balance

An illustrative trial balance indicating list of various accounts with their respective balances (i.e. debit or credit) is shown as below.

- Errors not Disclosed by Trial Balance

- Errors of complete omission

- Errors of principles

- Compensating errors

- Incorrect amount entered in the journal

- Posting to the wrong account.

- An entry posted twice in the ledger.

Bank Reconciliation Statement

- Meaning

Bank reconciliation statement is prepared mainly to reconcile the different between the bank balance as shown by the cash book and bank pass book.

- Need and importance of Bank Reconciliation Statement

- It helps in locating any error that may have been committed enter in the cash book or in the pass book.

- It helps in bringing out the unnecessary delay in the collection of cheques by the bank.

- Embezzlements are avoided by regular periodic reconciliation.

- The customer is assured of the correctness of bank balance shown by the pass book, by prepared a bank reconciliation statement.

- It helps the management to keep a track of cheque which has been sent to the bank for collection.

- Bank Pass Book (or Bank Statement)

Bank pass book id a copy of the customer’s account in books of a bank to customer/account holder so that entries can be complete with entries in cash book and the difference can determined.

- Reasons of Different between Cash Book and Pass Book Balances

The differences between the cash book and the bank pass book is caused by

- Differences due to timing on recording any transaction

The factors affecting time gap includes

-

-

- Cheques issued by the bank but not yet presented for payment.

- Cheques paid/deposited into the bank but not yet collected.

-

- Transactions recorded by the bank

- Direct debits made by the bank on behalf of the customer.

- Amounts directly deposited in the bank account by the customer.

- Interest and dividend collected by the bank.

- Direct payments made by the bank on behalf of the customers.

- Interest credited by the bank but not recorded in the cash book.

- Cheque deposited/bills discounted dishonored.

- Differences caused by errors

- Errors committed in recording transactions by the firm.

- Errors committed in recording transactions by the bank.

- Preparation of Bank Reconciliation System without Adjusting Cash Book Balance

Under this approach, the balance as per cash book or the balance as per pass book is taken as the starting item. The debit balance or favourable balance as per the cash books means the balance of deposits held at the bank. Such a balance will be credit balance or favourable balance as per the pass book.

On the other hand, the credit balance or unfavourable balance as per the cash book indicates bank overdraft. Such a balance will be a debit balance or unfavourable balance as per the pas book. An overdraft is treated as negative figure on a bank reconciliation statement. When the starting point or the first item in the statement is the overdraft (unfavourable) balance, it is to be shown on the minus side. It is to be noted, all the items in case of overdraft are debit in the same manner, as in the cash of favourable balances (Whether cash/pass book). Unfavourable balance or overdrafts implies credit balance in cash book of debit balance in pass book.

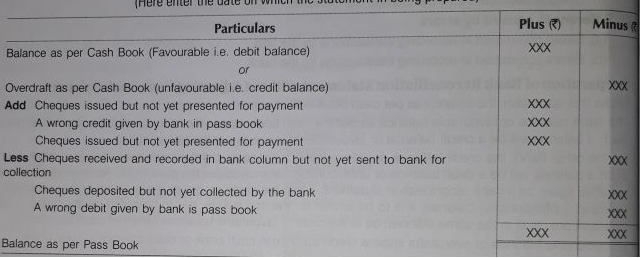

Format of bank reconciliation statement when the bank balance as per cash book is taken as a starting point.

Bank Reconciliation Statement

As on…

(Here enter the date on which the statement is being prepared)

- When the balance as per Pass Book is taken as the starting point, the treatment of all items will be reversed, i.e. item that are added, will be deducted and item that are deducted will be added.

- Either favourable balance or overdraft shall appear.

- If the total of ‘plus item column’ exceeds the total of ‘minus items column’ the difference between the two is termed as an overdraft.

- Preparation of Bank Reconciliation Statement with Adjusted/Amended Cash Book Balance

Another method of preparing bank reconciliation statement is on the basis of the balance of amended cash book. There are a number of items that appears only in the pass book so therefore, it is recommended that the cash book should be prepared to work out the adjustment balance (also known as amended balance) of the cash book and then prepare the bank reconciliation statement.

Bank Reconciliation Statement

As on…

(Here enter the date on which the statement in being prepared)

- When balance as per pass book is taken as the starting point, the treatment of all items will be reversed i.e. items that are added will be debuted and items to be deducted will be added.