TS Grewal Solutions for Class 11 Accountancy Chapter 13 – Depreciation

Question 1.

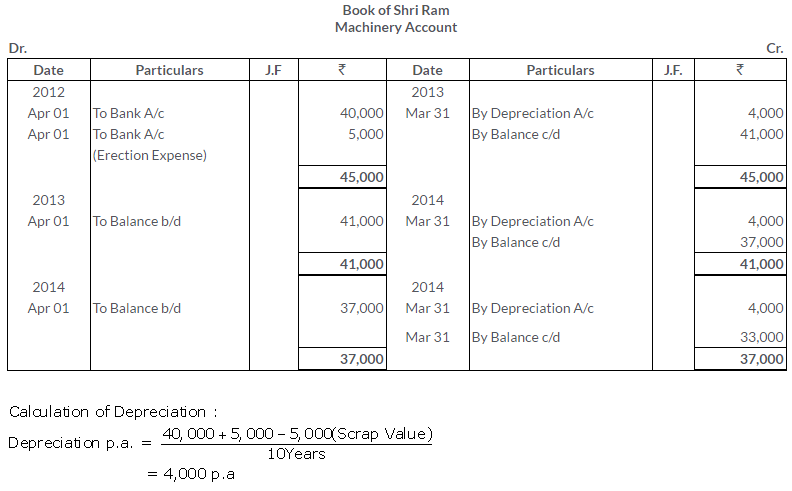

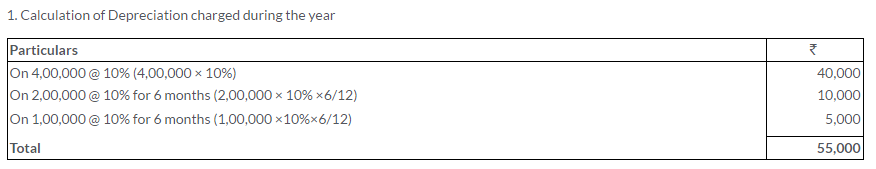

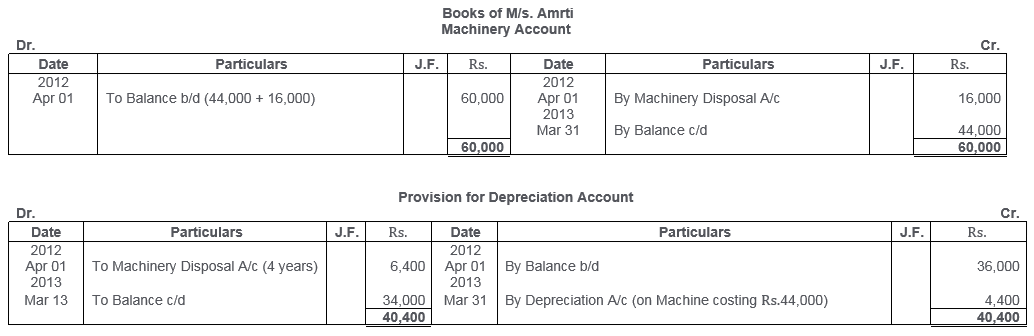

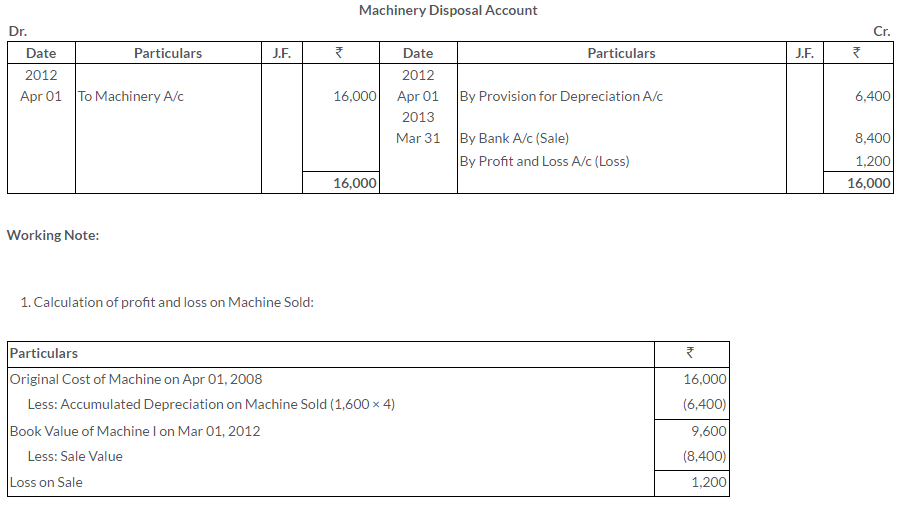

On 1st April, 2012, Shri Ram purchased a machinery costing Rs.40,000 and spent Rs.5,000 on its erection. The estimated effective life of the machinery is 10 years with a scrap valued of Rs.5,000. Calculate the Depreciation on the Straight Line Method and show the Machinery Account of first three years. Accounting year ends on 31st March every year.

Solution:

Question 2.

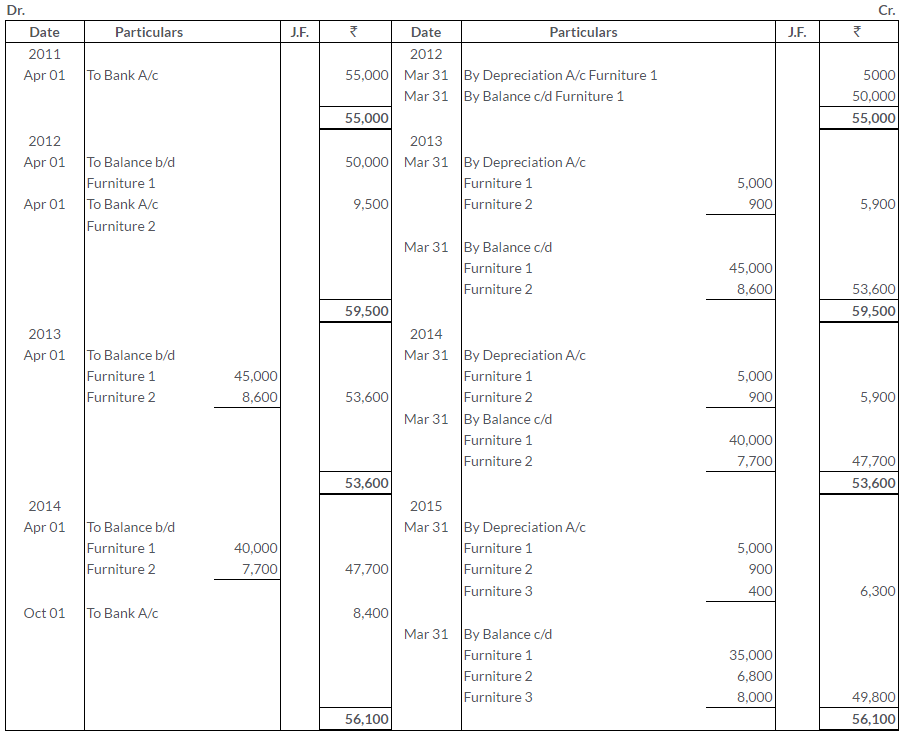

On 1st April, 2011, a merchant purchased a furniture costing Rs.55,000. It is estimated that its life is 10 years at the end of which it will be sold for Rs.5,000. Additions are made 1st April, 2012 and 1st October, 2014 to the value of Rs.9,500 and Rs.8,400 (Residual values Rs.500 and Rs.400 respectively).

Show the Furniture Account for the first four years, Depreciation A/c is written off according to the Straight Line Method.

Solution:

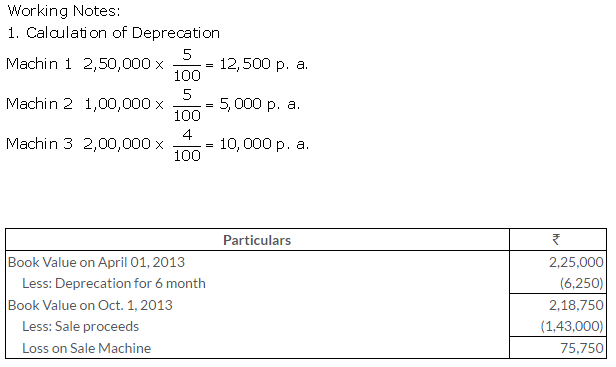

Question 3.

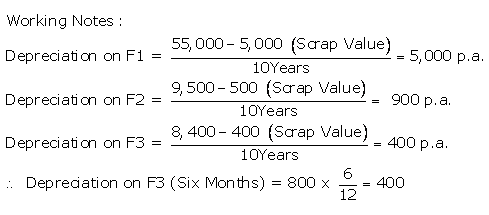

On 1st April, 2011, A Ltd. purchased a machine for Rs.2,40,000 and spent Rs.10,000 on its erection. On 1st October, 2011, an additional machinery costing Rs.1,00,000 was purchased. On 1st October, 2013 the machine purchased on 1st April, 2011 was sold for Rs.1,43,000 and on the same date, a new machine was purchased at a cost of Rs.2,00,000.

Show the Machinery Account for the first four financial years after charging Depreciation at 5% p.a. by the Straight Line Method.

Solution:

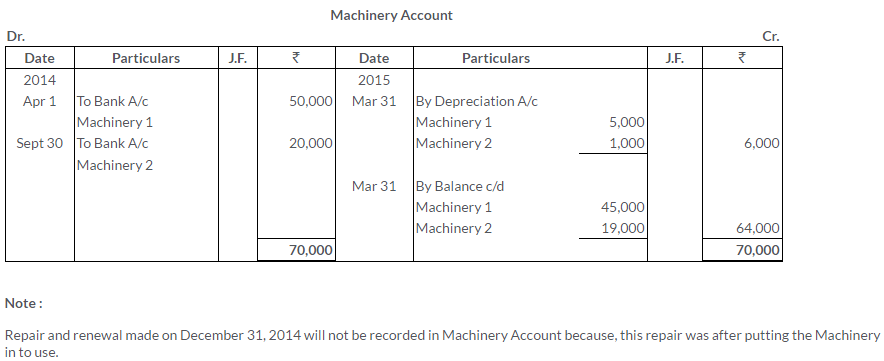

Question 4.

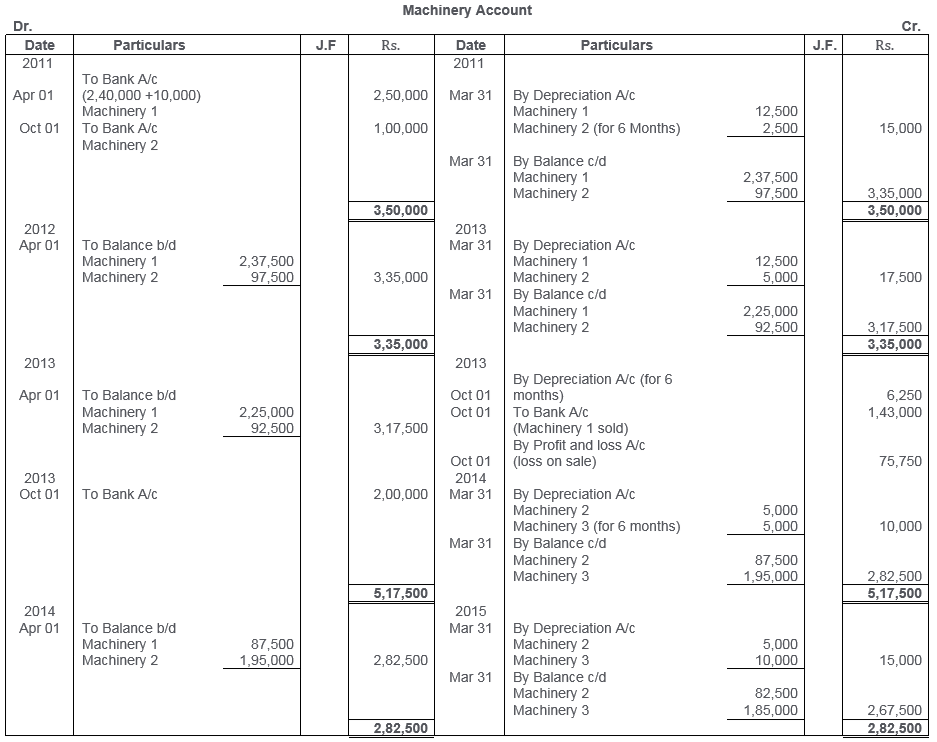

From the following transactions of a concern, prepare the Machinery Account for ended 31at March, 2015:

1st April, 2014: Purchased second-hand machinery for Rs.40,000.

1st April, 2014: Spent Rs.10,000 on repairs for making it serviceable.

30th September, 2014: Purchased additional new machinery fort 20,000.

31st December, 2014: Repairs and renewals of machinery Rs.3,000.

31st March, 2015 :Depreciate the machinery at 10% p.a.

Solution:

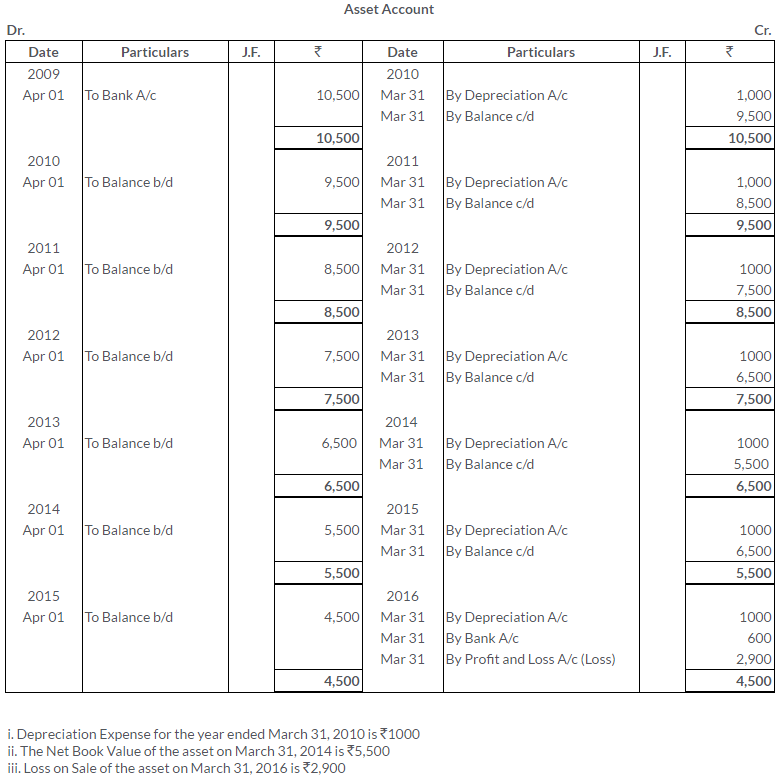

Question 5.

An asset was purchased for Rs.10,500 on 1st April, 2009. The scrap value was estimated be Rs.500 at the end of asset’s 10 years’ life. Straight Line Method of depreciation was used.

The accounting year ends on 31st March. The asset was sold for Rs.600 on 31st March, 2016. calculate the following:

a. The Depreciation expense for the year ended 31st March, 2010.

b. The net book value of the asset on 31st March, 2014.

c. The gain or loss on sale of the asset on 31st March, 2016.

Solution:

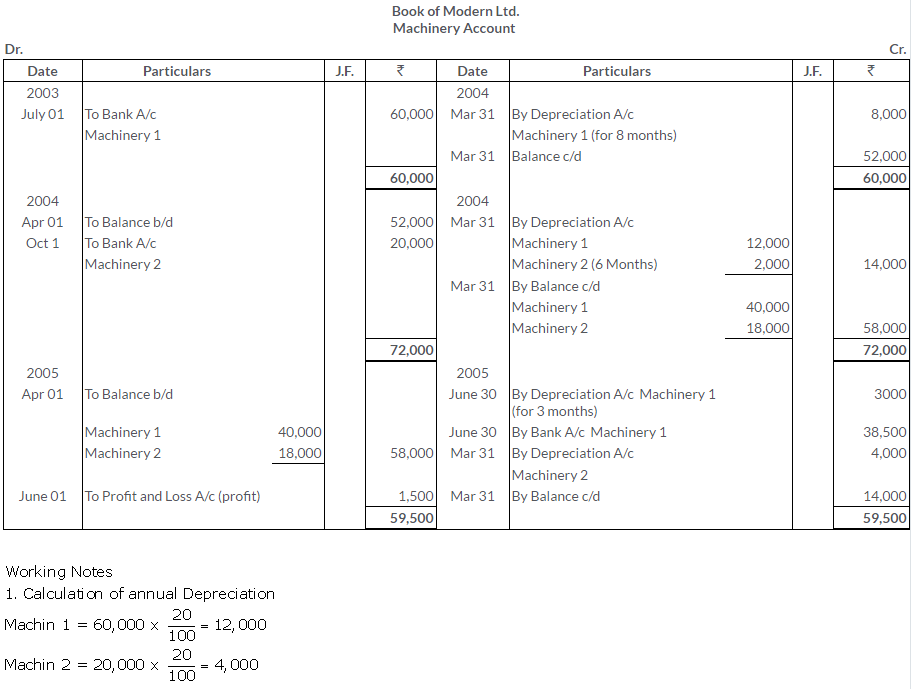

Question 6.

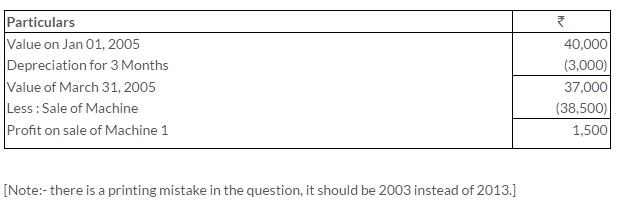

Modern Ltd. purchased machinery on 1st JulyRs.60,000. On 1st October, 2004 based another machine for Rs.20,000. On 30th June, 2005, it sold the first machine hosed in 2003 fort Rs.38,500. Depreciation-is provided at 20% p.a. on the original cost year. Accounts are closed on 31st March every year. Prepare the Machinery A/c for three year.

Solution:

Question 7.

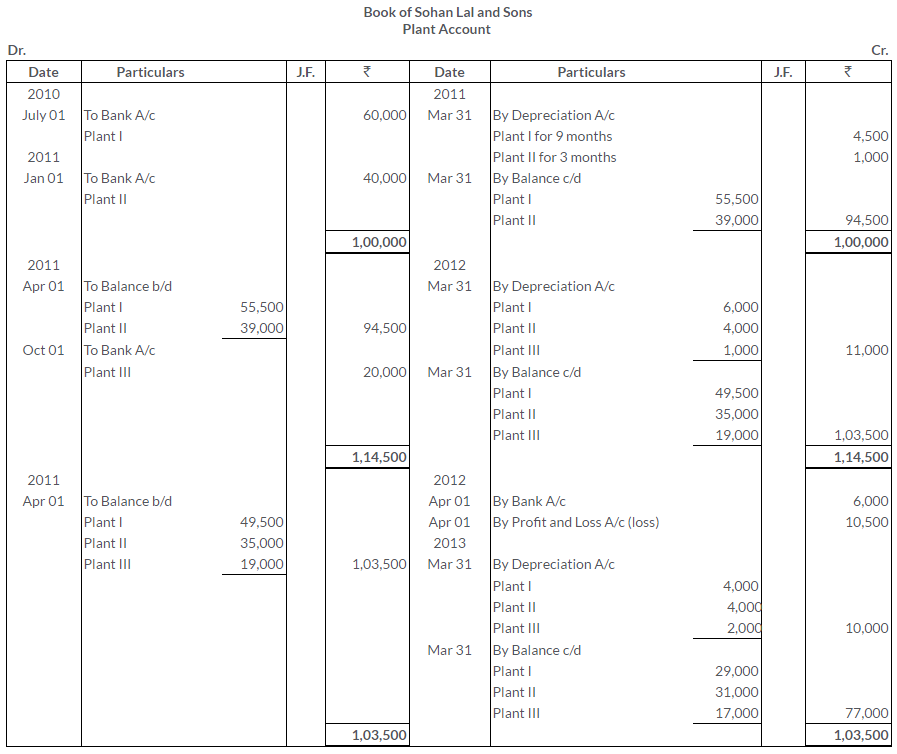

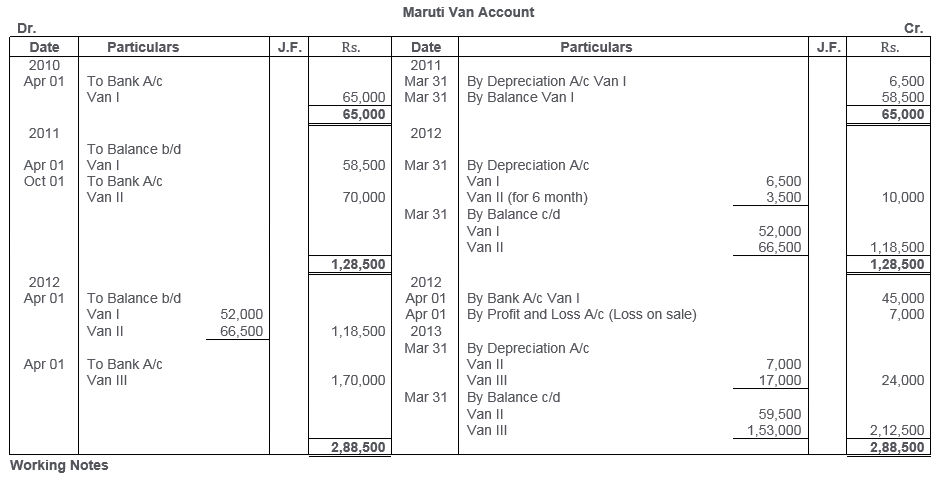

On 1st July. 2010, Sohan Lal and Sons purchased a plant costing Rs.60,000. Additional plant was purchased on 1st January, 2011 for Rs.40,000 and on 1st October, 2011, for Rs.20,000. On 1st April, 2012, one-third of the plant purchased on 1st July, 2010, was found to have become obsolete and was sold for Rs.6,000.

Prepare the Plant Account for the first three years in the books of Sohan Lal and Sons. Depreciation is charged @ 10% p.a. on Straight Line Method. Accounts are closed on 31st March each year.

Solution:

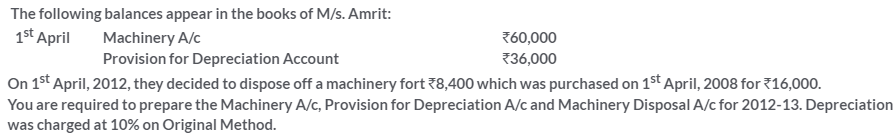

Question 8.

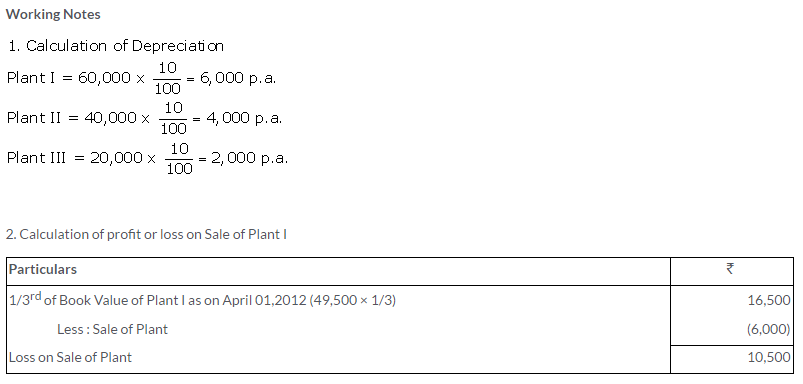

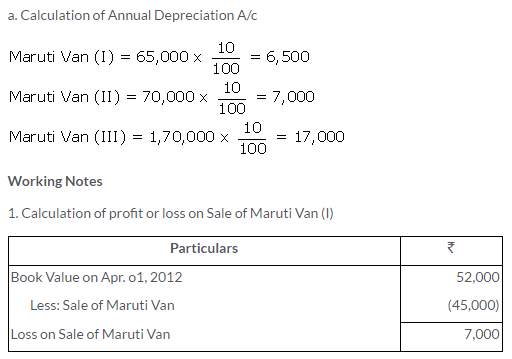

A Van was purchased on 1st April, 2010 for Rs.60,000 and Rs.5,000 was spent on its repair and registration. On 1st October, 2011 another van was purchased for Rs.70,000. On 1st April, 2012, the first van purchased on 1st April, 2000 was sold for Rs.45,000 and a new van costing Rs.1,70,000 was purchased on the same date. Show the Van Account from 2010 – 2011 to 2012-13 on the basis of Straight Line Method, if the rate of Depreciation charged is 10% p.a. Assume that books are closed on 31st March every year.

Solution:

Question 9.

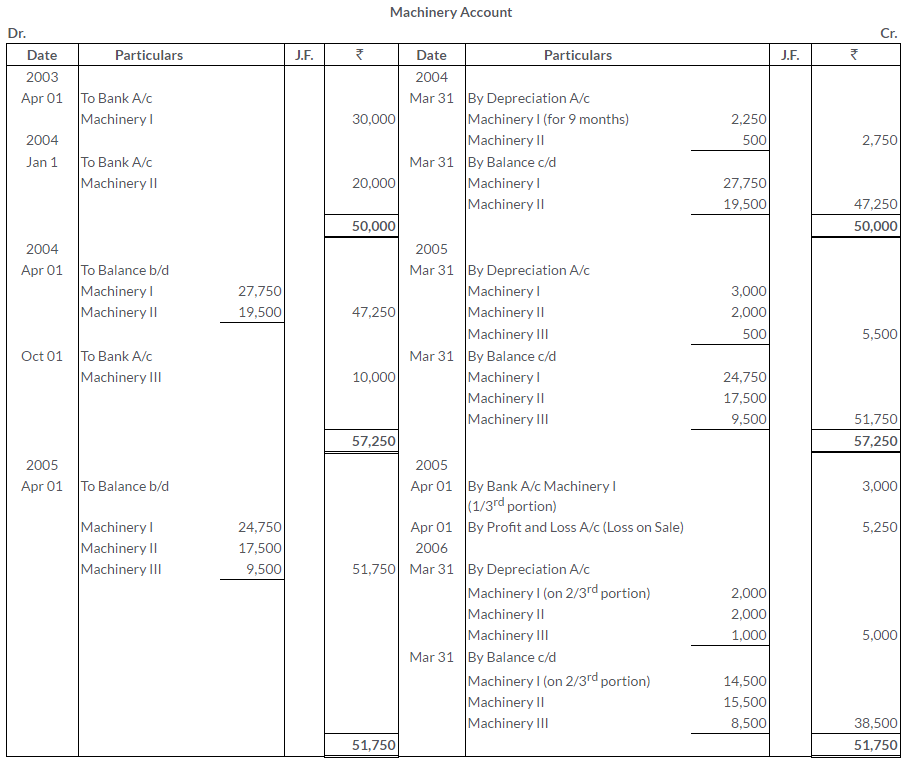

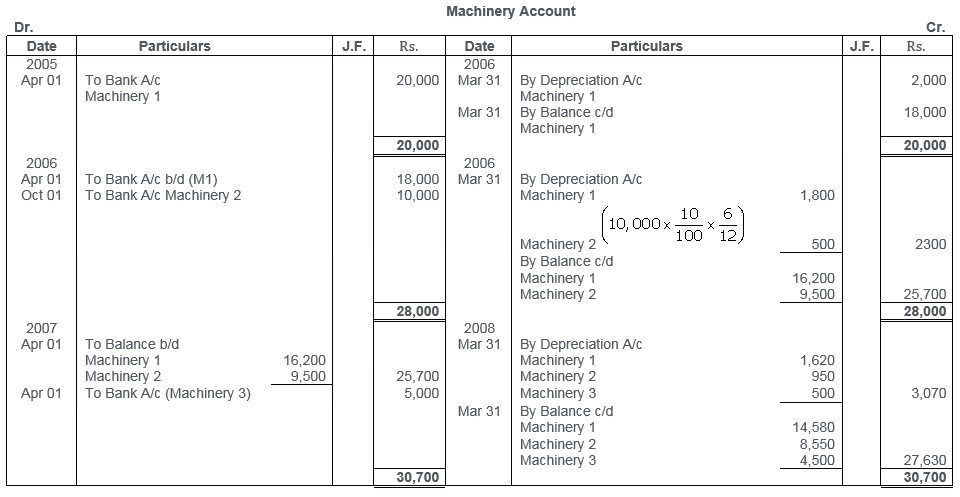

Company whose accounting year is a financial year, purchased on 1st July, 2003 machinery costing Rs.30,000. It purchased further machinery on 1st January. 2004 costing Rs.20,000 and on let October, 2004 costing Rs.10,000. On 1st April, 2005 one-third of the machinery installed on 1st July. 2003 became obsolete, and was sold for Rs.3,000.

Show how machinery Account would appear in the books of the company. It being given that machinery was depreciated by fixed installment Method at 10% p.a. What would be the value of Machinery Account on 1st April, 2006?

Solution:

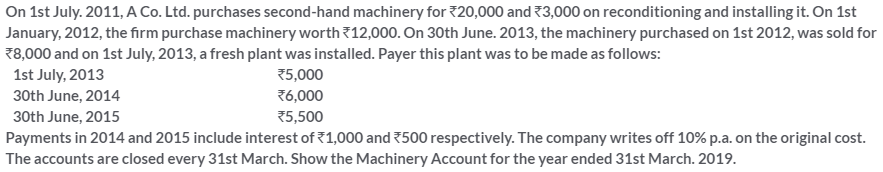

Question 10.

Solution:

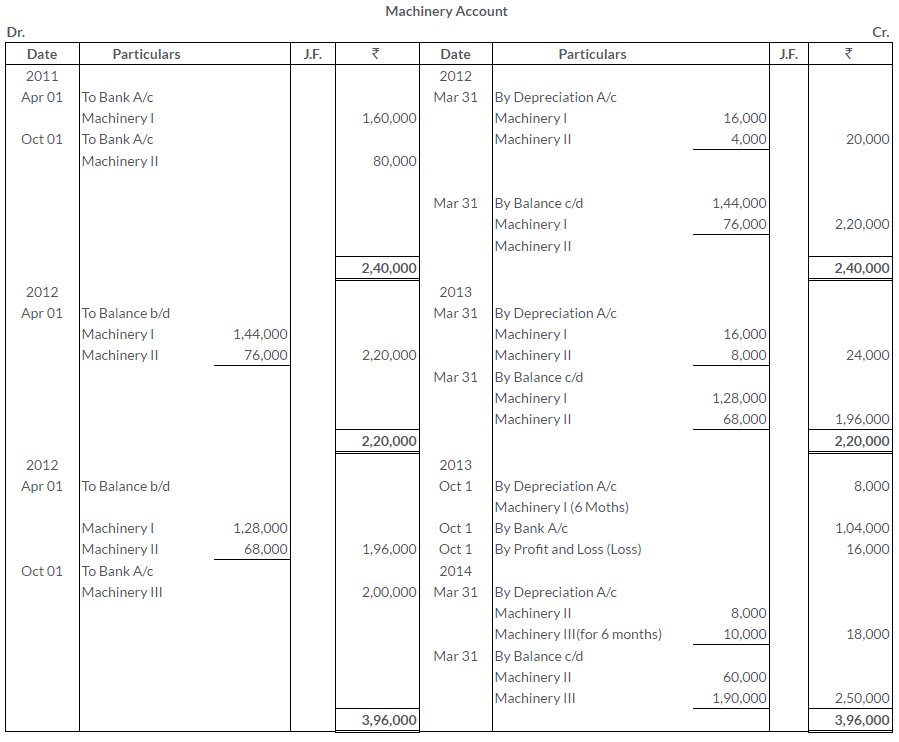

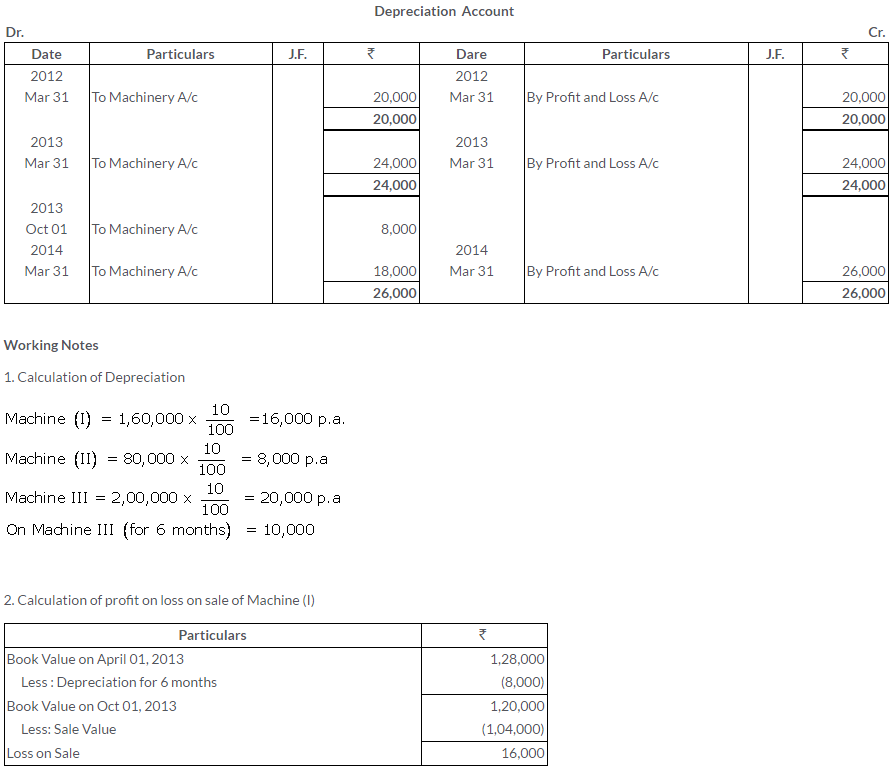

Question 11.

A firm purchased a second-hand machine on 1st April, 2011 and paid Rs.1,40,000 for it spent on its overhauling and installation Rs.20,000. On 1st October, 2011, another costing Rs.80,000 was purchased. On 1st October, 2013 the machine purchased on 1st April 2011 was disposed off for Rs.1,04,000 and a new machine costing Rs.2,00,000 was Depreciation was provided 10% p.a. by the Straight Line Method. Give the Account and Depreciation Account for 3 years. Firm’s books are closed on 31st March.

Solution:

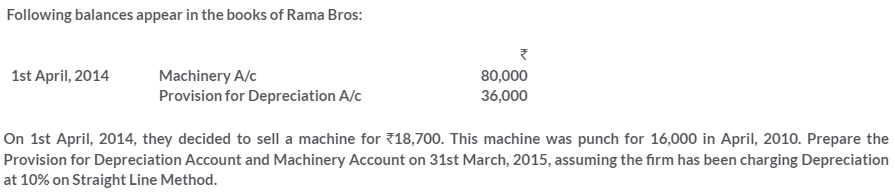

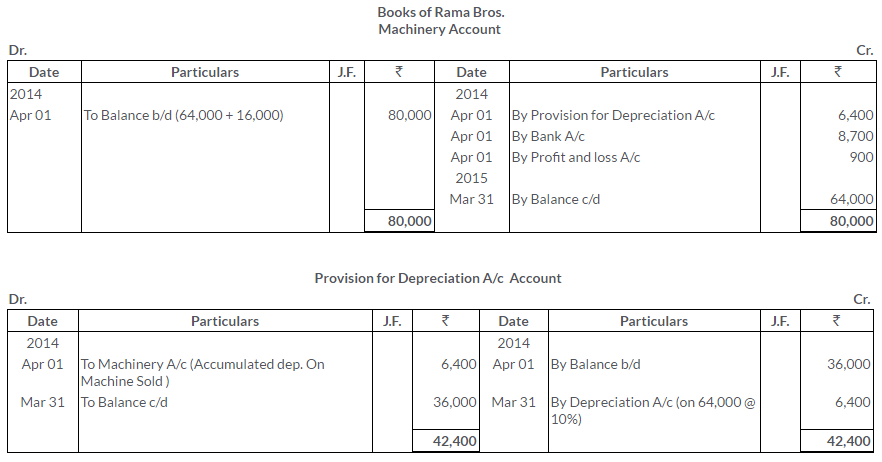

Question 12.

Solution:

Question 13.

Solution:

Question 14.

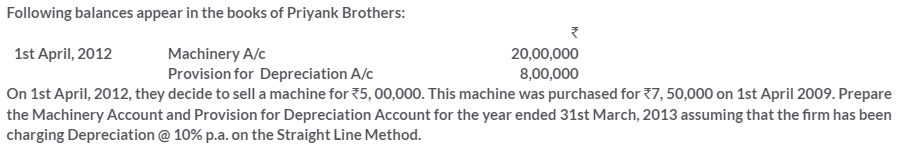

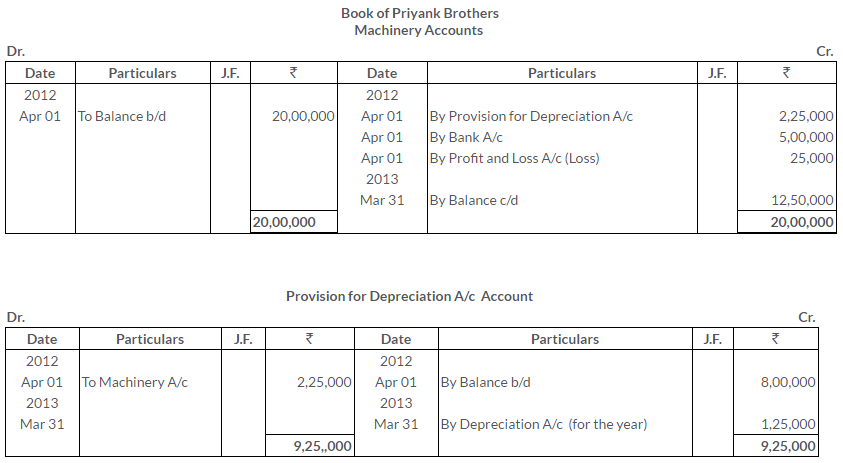

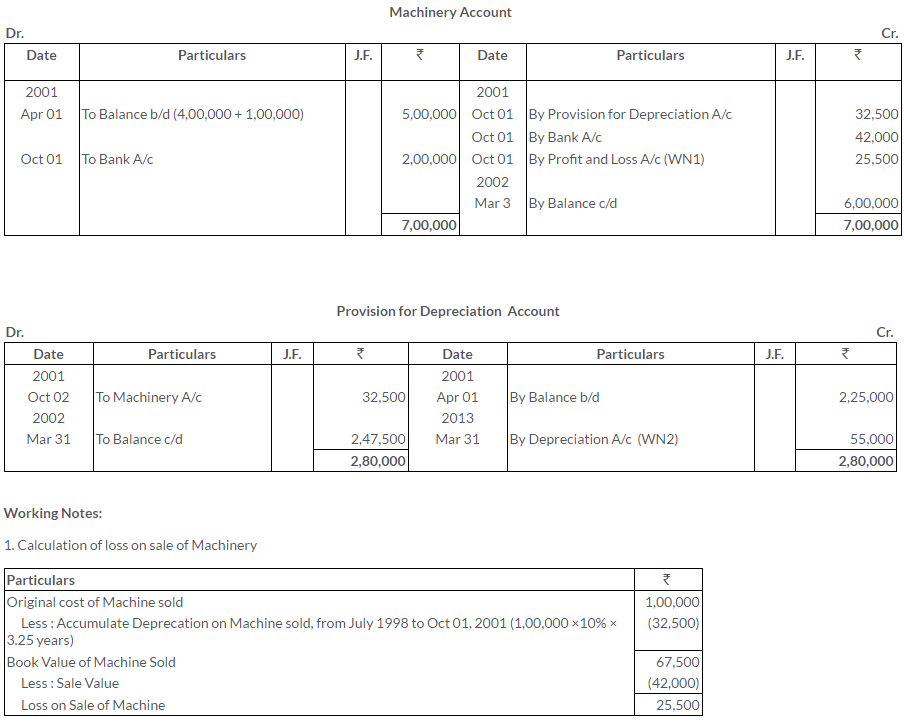

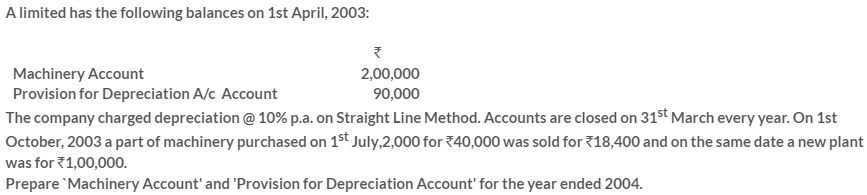

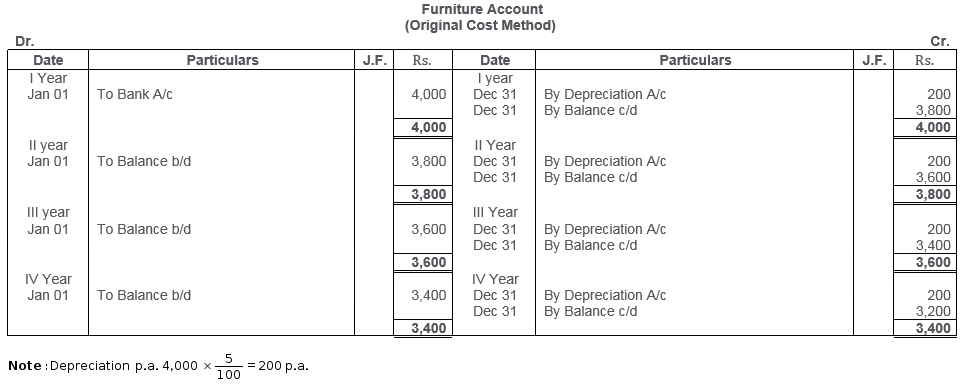

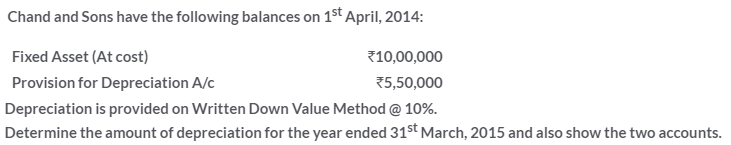

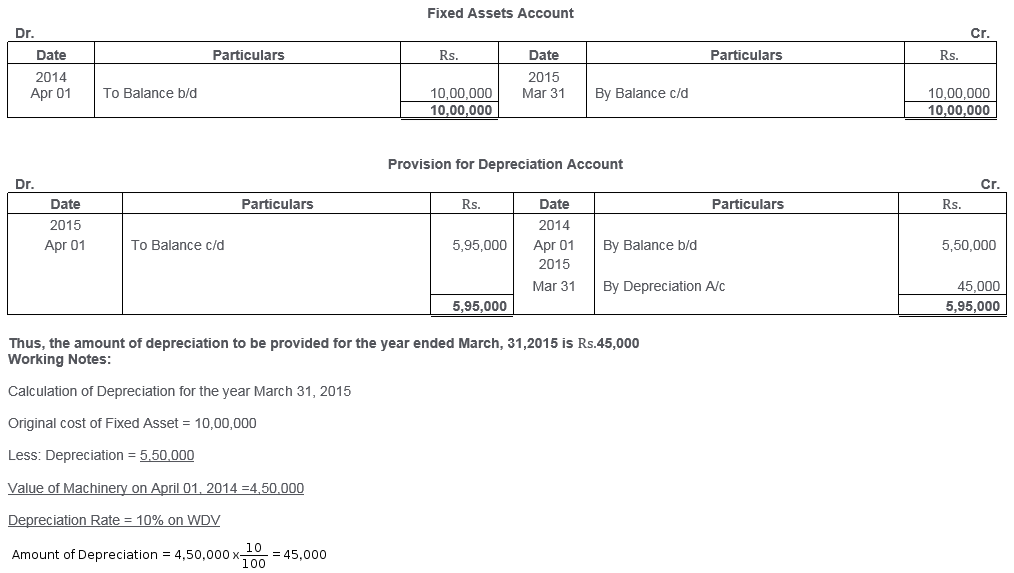

Following balances appear in the boobs of X Ltd. as on 1st April. 2001:

Machinery Account = Rs.5,00,000

Provision for Depreciation = Rs.2,25,000

The machinery is depreciated at 10% p.a. on the Fixed Installment Method. The accounting being April-March. On 1st October, 2001, a machinery which was purchased on, 1998 for Rs.1,00,000 was sold for Rs.42,000 and on the same date a new machine was purchased for Rs.2,00,000. Prepare Machinery Account and Provision for Depreciation A/c for the year ended 31st March. 2002.

Solution:

Question 15.

Solution:

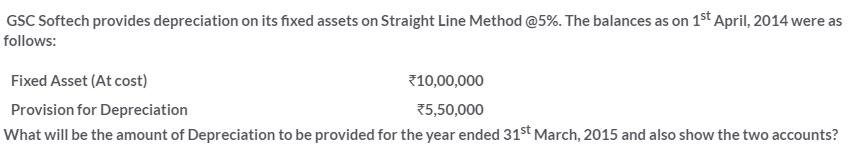

Question 16.

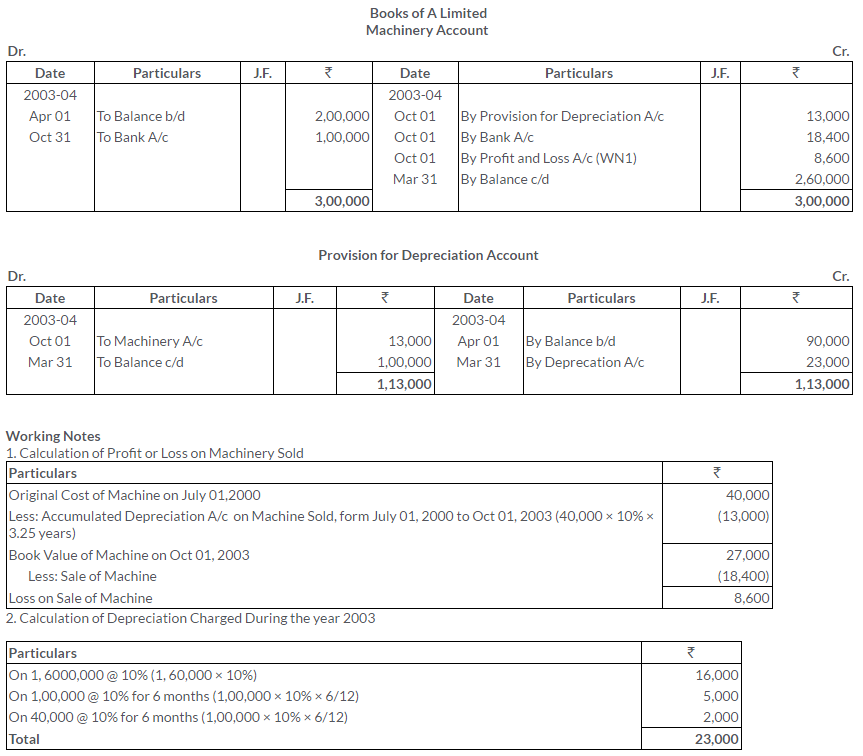

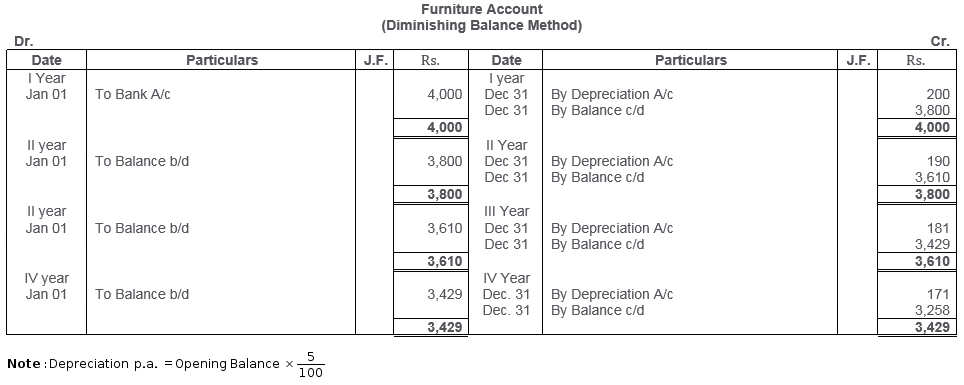

The original cost of furniture amounted to Rs.4,000 and it is decided to write off 5% on the cost as Depreciation at the end of each year. Shows the Ledger Account as it will appear during the first four years. Show also how the same account will appear if it was write off 5% on the diminishing balance of the asset each year.

Solution:

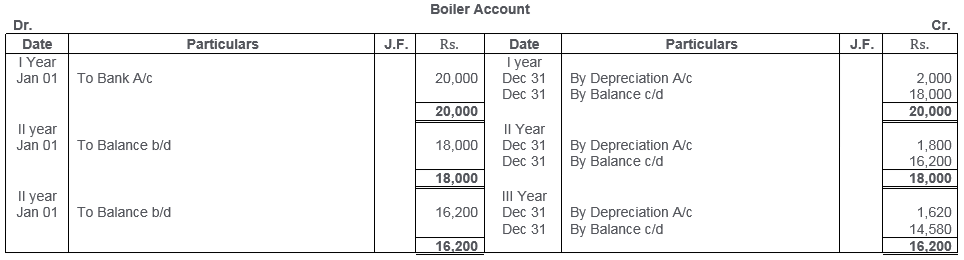

Question 17.

A boiler purchased from abroad for Rs.10,000;shipping and forwarding charges Rs.2,000, Import duty Rs.7,000 and expenses of installation amounted to Rs.1,000.

Calculate the Depreciation for the first three years (separately for each year) @ 10% on diminishing Method.

Solution:

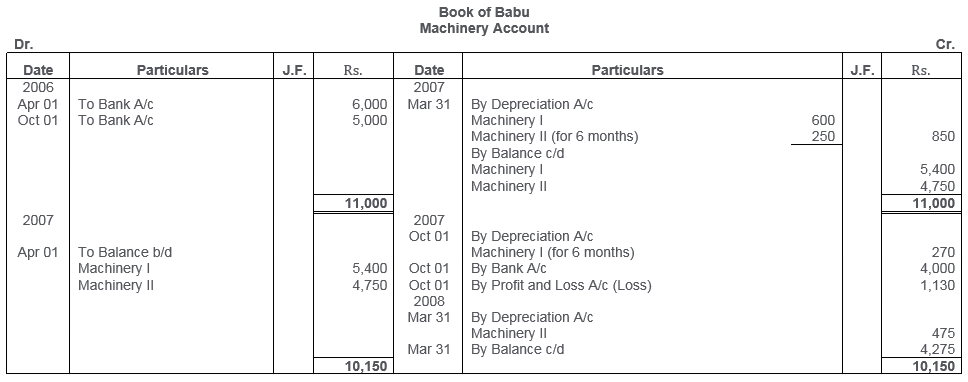

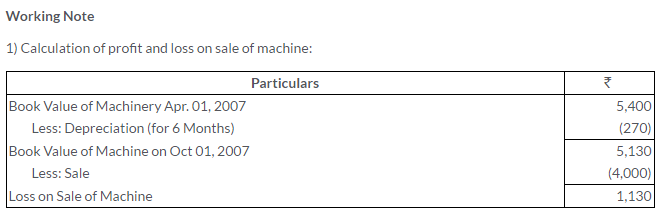

Question 18.

Babu purchased on 1st April, 2006, a machine fort Rs.6,000. On 1st October, 2006, he also purchased another machine for Rs.5,000. On 1st October, 2007, he sold the machine on 1st April, 2006 for Rs.4,000.

It was decided that Depreciation @10% p.a. was to be written off every year under diminishing Balance Method.

Assuming the accounts were closed on 31st March every year, show the machinery Account for the years ended 31st March,2007 and 2008.

Solution:

Question 19.

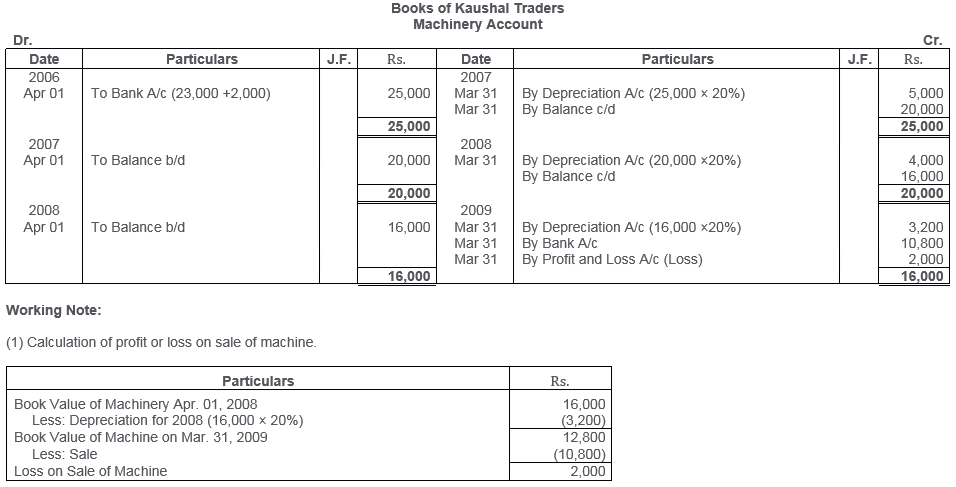

Kaushal Traders purchased second-hand machinery on 1st April, 2006 for Rs.23,000 and spent Rs.2,000 in its repair. It was decided to depreciate the machinery @20% every year on 31st March at Diminishing Balance Method.

Prepare the Machinery Account from years ended 31st March, 2007 to 2009 and show Profit or Loss as it was sold on 31st March 2009 for Rs.10,800.

Solution:

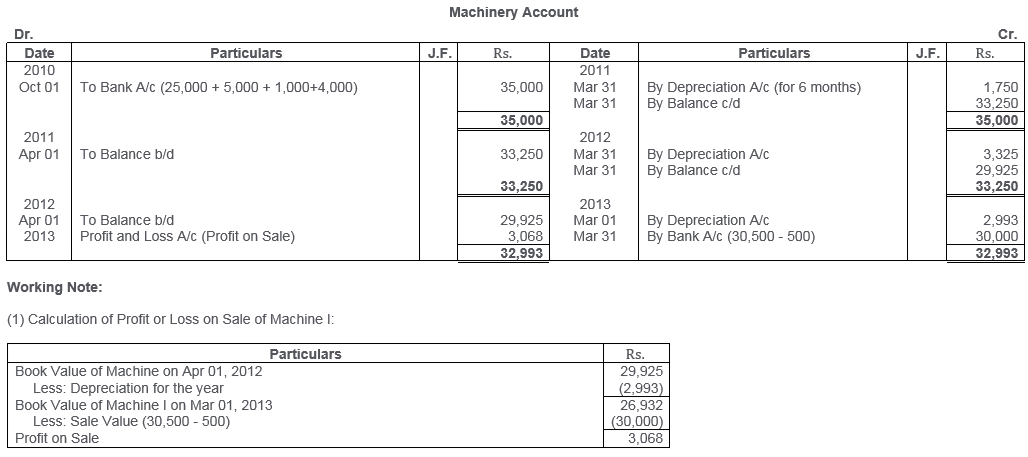

Question 20.

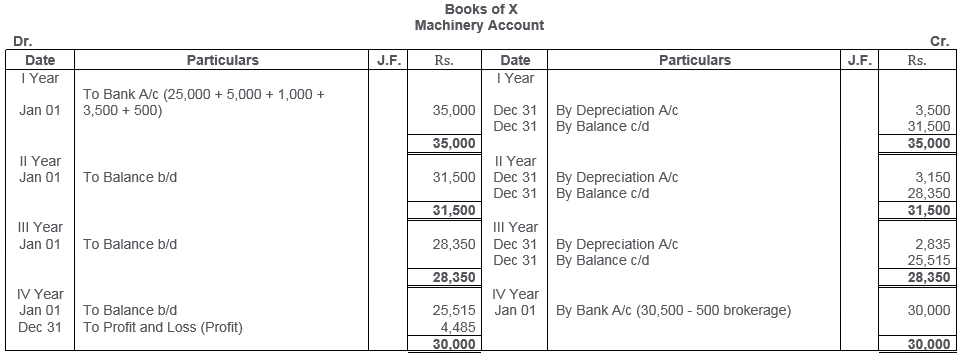

X bought a machine for Rs.25,000 on which he spent Rs.5,000 for carriage and freight, Rs.1,000 for brokerage of the middleman, Rs.3,500 for installation and Rs.500 for an iron pad. Machine is depreciated @ 10% every year on Written Down Value basis. After three years, the machine was sold to Y for Rs.30,500 and Rs.500 was paid as commission to the broker through whom the sale was effected. Find out the profit and loss on sale of machine.

Solution:

Question 21.

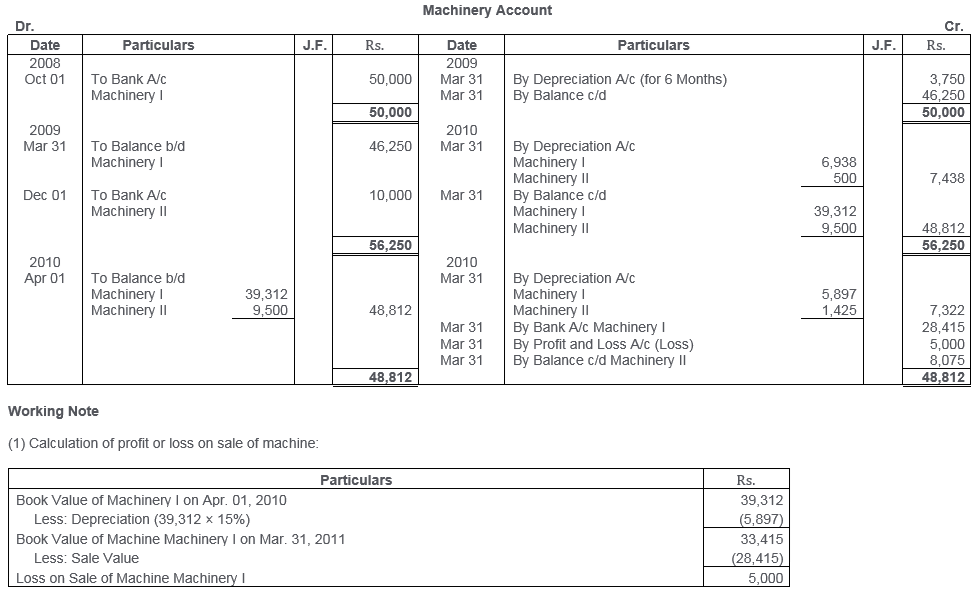

A company purchased machinery for Rs.50,000 on 1st October, 2008. Another machinery costing Rs.10,000 was purchased on 1st December, 2009. On 31st March, 2010, the machinery purchased in 2008 was sold at a loss of Rs.5,000. The company charges depreciation at the rate of 15% p.a. on Diminishing Balance Method. Accounts are closed 31st March every year. Prepare the Machinery Account for 3 years.

Solution:

Question 22.

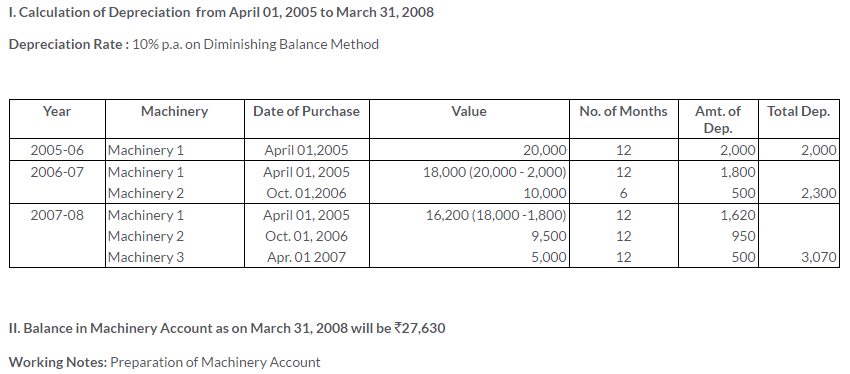

On 1st April, 2005, machinery was purchased for Rs.20,000. On 1st October, 2006 another machine was purchased for Rs.10,000 and on 1st April, 2007, one more machine was purchased for Rs.5,000. The firm depreciates its machinery @ 10% on the Diminishing Balance Method. What is the amount of Depreciation for the years ended 31st March, 2006; 2007 and 2008?

What will be the balance in Machinery Account as on 31st March, 2008?

Solution:

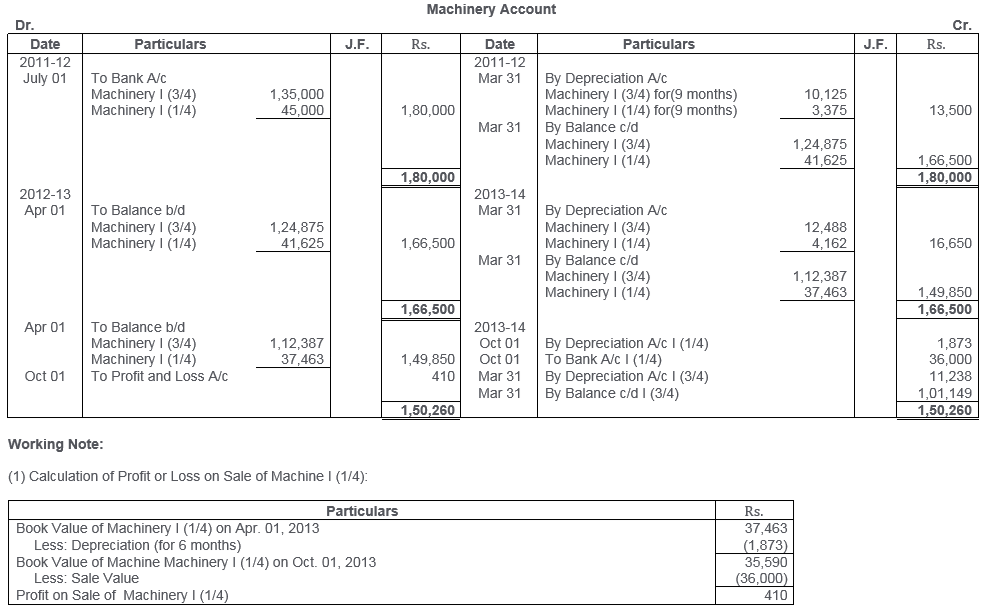

Question 23.

A Machinery was purchased for Rs.1,80,000 on 1st July, 2011. Depreciation was charged annually @ 10% on Diminishing Balance Method. 1/4th of this Machinery was sold on 1st October, 2013 for 36,000. Prepare Machinery A/c from the year ended 31st March, 2012 to 2014, if the books are closed on 31st March every year.

Solution:

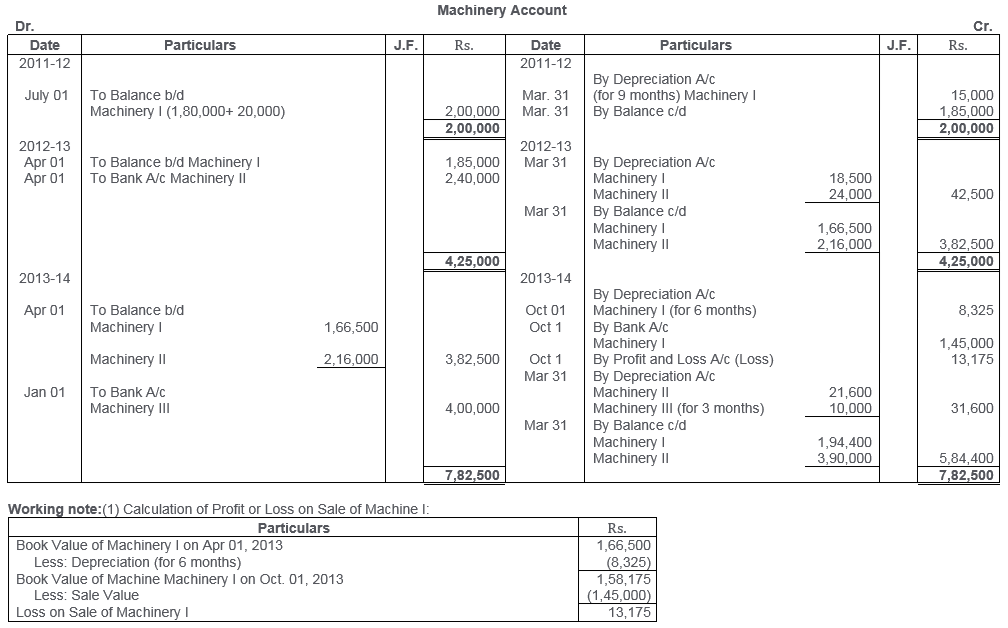

Question 24.

Astha Engineering Works purchased a machine on 1st July, 2011 for Rs.1, 80,000 and spent Rs.20,000 on its installation.

On 1st April, 2012, it purchased another machine for Rs.2,40,000. On 1st October, 2013, the machine purchased on 1st July, 2011 was sold for Rs.1,45,000. On 1st January, 2014 another machine was purchased for Rs.4,00,000.

Prepare the Machine Account for years ended 31st March, 2012 to 2014 after charging Depreciation @10% p.a. by Diminishing Balance Method.

Accounts are closed on 31st March every year.

Solution:

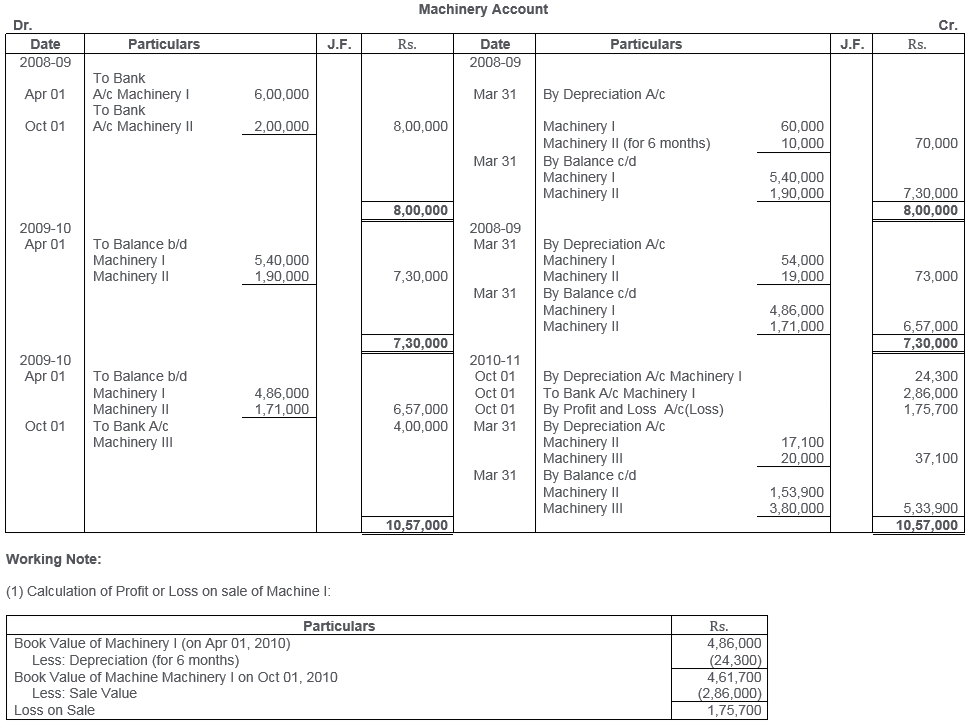

Question 25.

A firm purchased on 1st April 2008 certain machinery for Rs.5,82,000 and spent Rs.18,000 on its erection. On 1st October, 2008, additional machinery costing Rs.2,00,000 was purchased.

On 1st October, 2010, the machinery purchased on 1st April, 2008 was auctioned for Rs.2,86,000 and a new machinery for Rs.4,00,000 was purchased on the same date. Depreciation was provided annually on 31st March at the rate of 10% on the Written Down Value Method. Prepare the Machinery Account for the years ended 31st March, 2009 to 2011.

Solution:

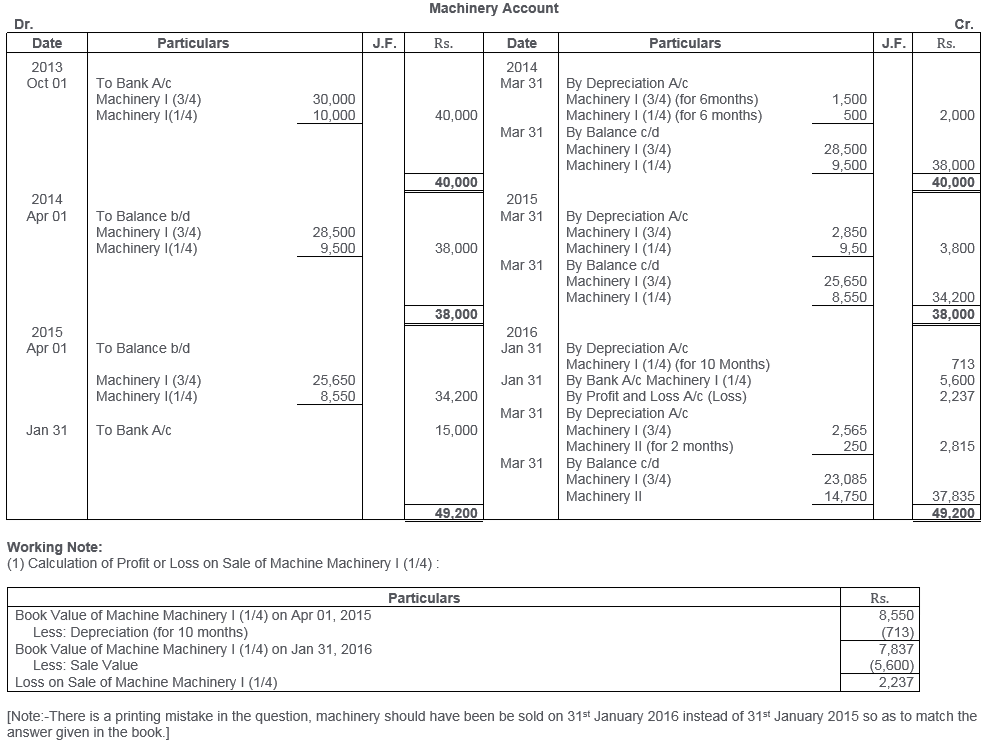

Question 26.

M/s. P and Q purchased machinery for Rs.40,000 on 1st October, 2013. By Depreciation is provided @10% p.a. on the Diminishing Balance. On 31st January, 2015, one-fourth of the machinery was found unsuitable and disposed off for Rs.5,600. On the same date new machinery at a cost of Rs.15,000 was purchased. Write up the Machinery Account for the years ended 31st March, 2014 and 2015. The accounts are closed on 31st March.

Solution:

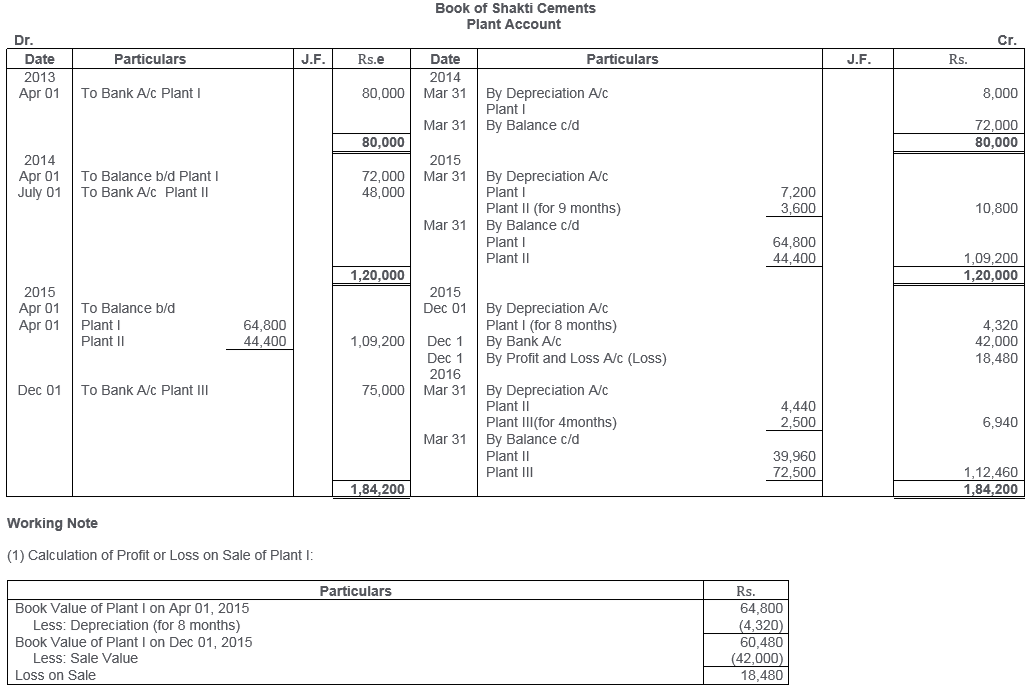

Question 27.

Shakti Cements purchased on 1st April, 2013 a plant for Rs.80,000. On 1st July, 2014 it purchased additional plant costing Rs.48,000. On 1st December, 2015 the plant purchased on 1st April, 2013 was sold for Rs.42,000 and on the same date a fresh plant was purchased for Rs.75,000. Depreciation is provided at 10% p.a. on the Diminishing Balance Method. Accounts are closed on 31st March each year. Show the Plant Account for 3 years (along with working notes).

Solution:

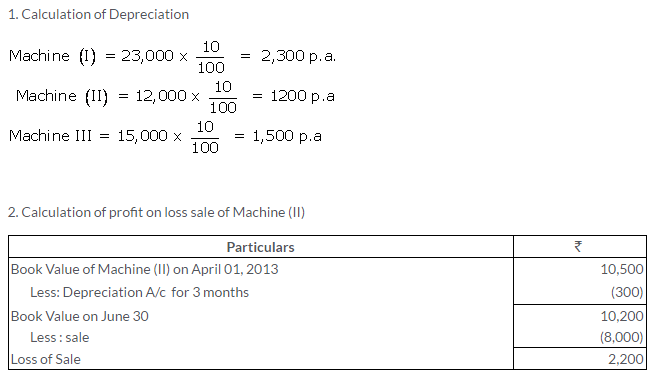

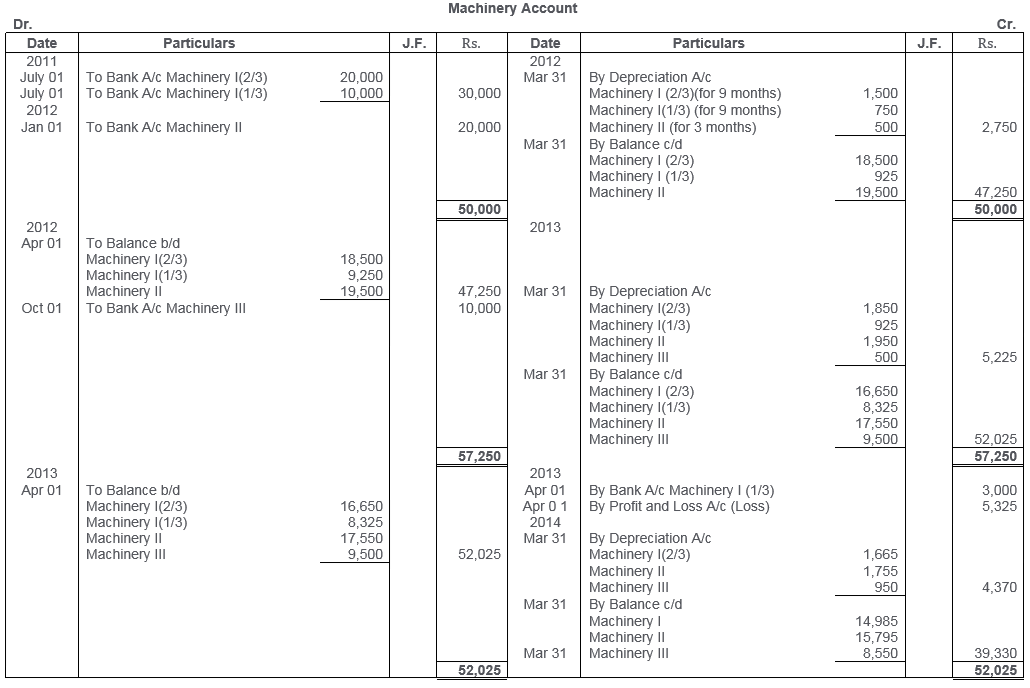

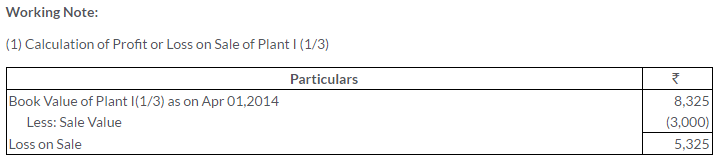

Question 28.

A company purchased on 1st July, 2011 machinery costing Rs.30,000. It further purchased machinery on 1st January, 2012 costing Rs.20,000 and on 1st October, 2012 costing Rs.10,000. On 1st April, 2013 one-third of the machinery installed on 1st July, 2011 became obsolete and was sold for Rs.3,000.

The company follows financial year as accounting year.

Show how the Machinery Account would appear in the books of company if depreciation is charged @ 10% p.a. on Written Down Value Method.

Solution:

Question 29.

On 1st October, 2010, Meenal Sharma bought a machine for Rs.25,000 on which he spent Rs.5,000 for carriage and freight; Rs.1,000 for brokerage of the middle-man, Rs.4,000 for installation. The machine is depreciated @ 10% p.a. on written down value basis. On 31st March, 2013 the machine was sold to Deepa for Rs.30,500 and Rs.500 was paid as commission to broker through whom the sales was affected. Find out the profit or loss on sale of machine if accounts are closed on 31st March, every year.

Solution:

Question 30.

Solution:

Question 31.

Solution:

Question 32.

Solution:

Question 33.

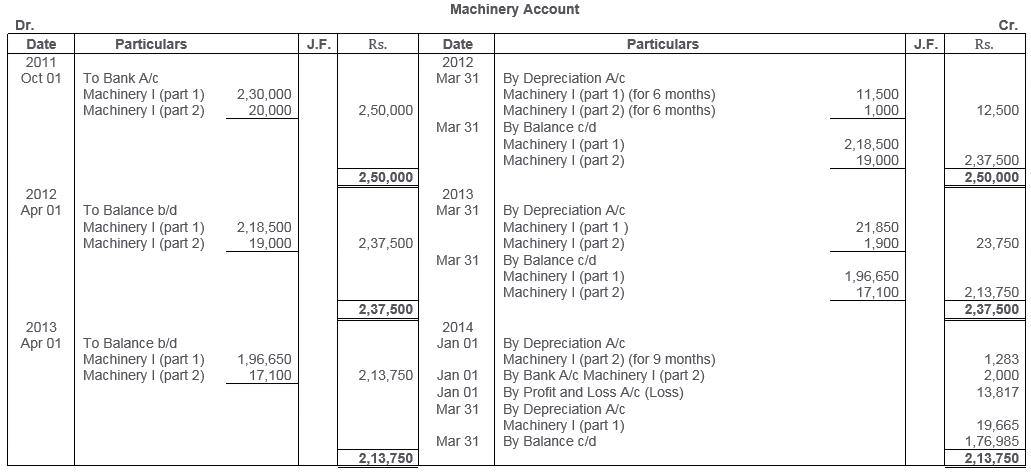

On 1st October, 2011, X Ltd. purchased a machinery for Rs.2,50,000. A part of machinery which was purchased for Rs.20,000 on 1st October, 2011 became obsolete and was disposed off on 1st January, 2014 (having a book value Rs.17,100 on 1st April, 2013) for Rs.2,000. Depreciation is charged @10% annually on written down value. Prepare machinery disposal account and also show your workings. The books being closed on 31st March of every year.

Solution:

Question 34.

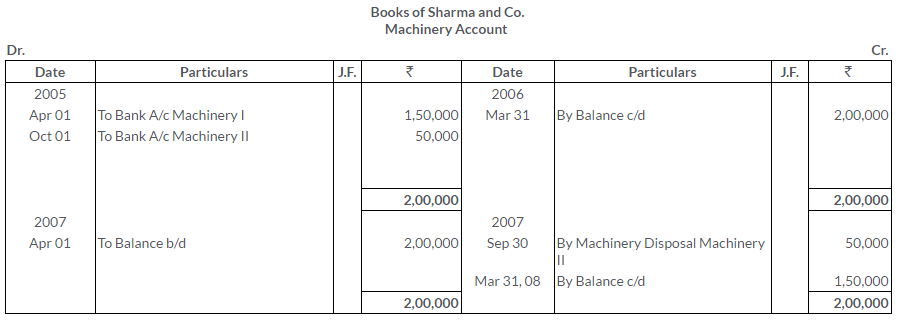

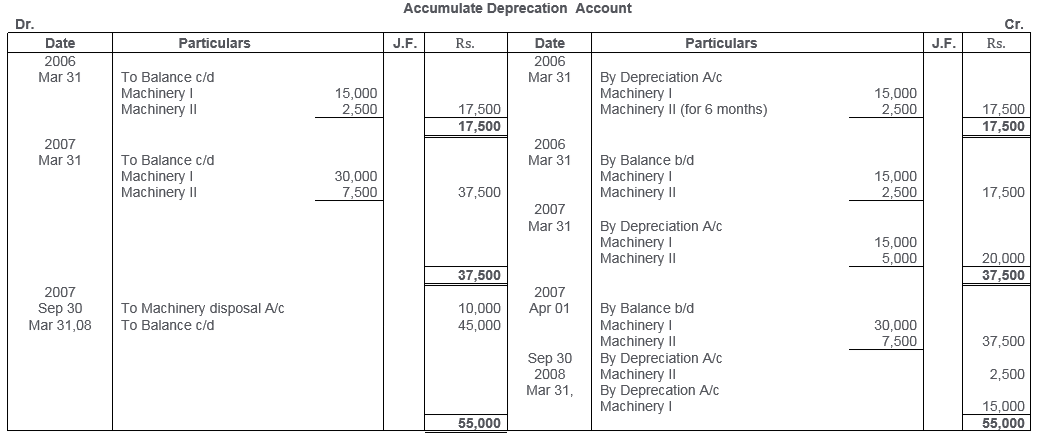

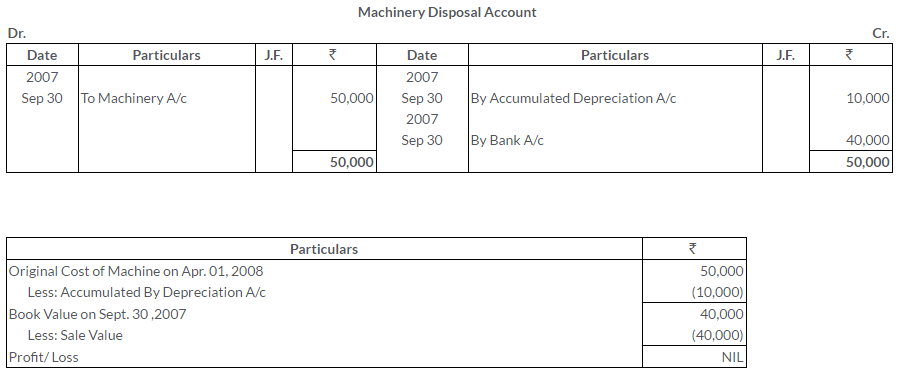

Sharma and Co. whose books are closed on 31st March, purchased machinery for Rs.1, 50,000 on 1st April, 2005, Additional machinery was acquired for Rs.50,000 on 1st October, 2005. Certain machinery which was purchased for Rs.50,000 on 1st October, 2005 was sold for Rs.40,000 on 30th September, 2007.

Prepare the Machinery Account and Accumulated Depredation Account for all the yeas up to the year ended 31st March, 2008. Depreciation is charged @ 10% p.a. on Straight Line Method. Also, show the Machinery Disposal Account.

Solution:

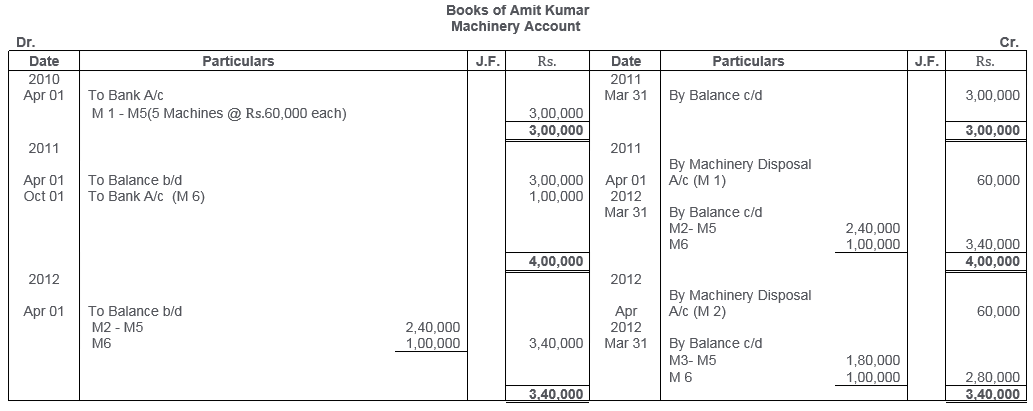

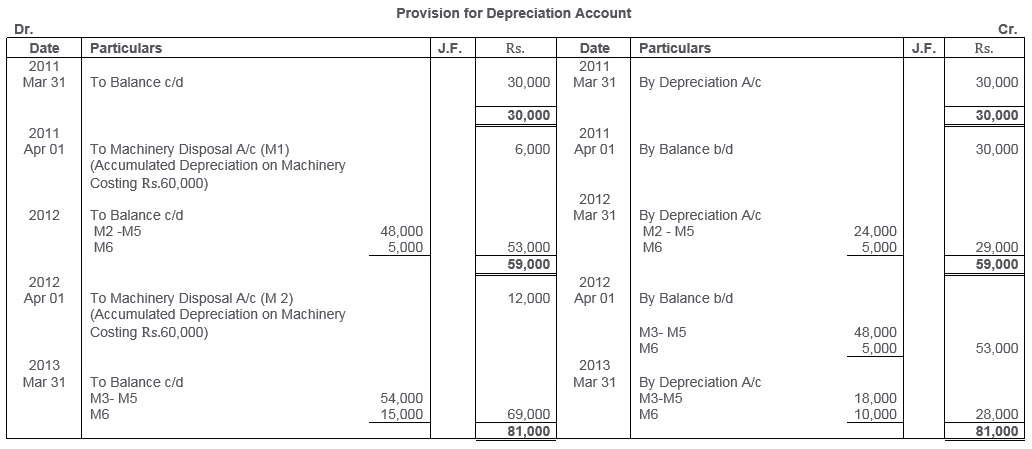

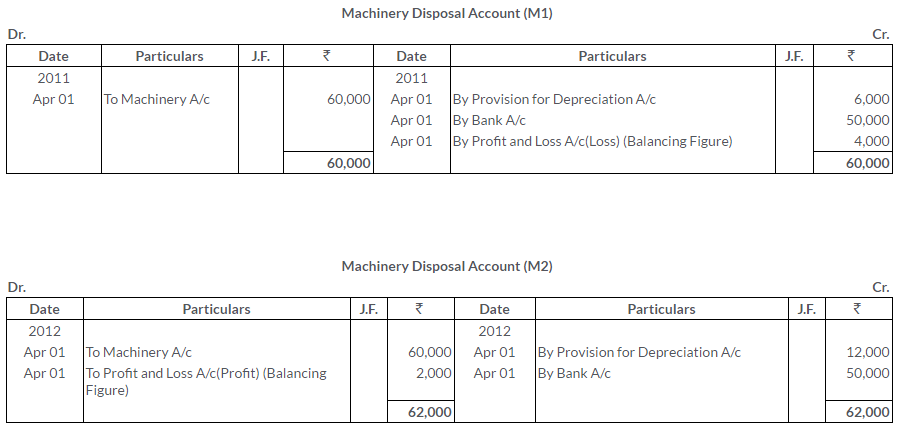

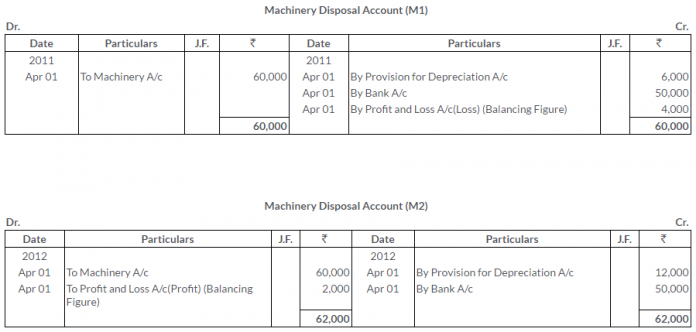

Question 35.

On 1st April, 2010 Amit Kumar purchased five machines for Rs.60,000 each. Depreciation @ 10% p.a. on initial cost has been charged from the Profit and Loss Account and credited to Provision for Depreciation Account.

On 1st April, 2011 one machine was sold for Rs.50,000 and on 1st April, 2012 another machine was sold for Rs.50,000. An improved model costing Rs.1,00,000 was purchased on 1st October, 2011. Amit Kumar closes his books on 31st March each year.

You are required to show:

(i) Machinery Account; (ii) Machinery Disposal Account and (iii) Provision for Depreciation Account for the period of three accounting years ended 31st March, 2013

Solution: