TS Grewal Solutions for Class 11 Accountancy Chapter 18 – Adjustments in Preparation of Financial Statements

Question 1.

Solution:

Question 2.

Solution:

Question 3.

Solution:

Question 4.

Solution:

Question 5.

Solution:

Question 6.

Solution:

Question 7.

Additional information:

i. Closing Stock on 31st March, 2016 was Rs.21,000.

ii. Rent of Rs.1,200 has been received in advance.

iii. Outstanding liability for trade expenses Rs.12,000.

iv. Commission earned during the year but not received was Rs.2,100.

Solution:

Question 8.

Solution:

Question 9.

Adjustments:

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2016 and Balance Sheet as at that date after taking into account the following:

i. Depreciate Land and Building at 2½% and Motor Vehicles at 20%.

ii. Salaries outstanding Rs.200.

iii. Prepaid Insurance Rs.200.

iv. Provision for Doubtful Debts is to be maintained at 5% on Debtors.

v. Stock on 31st March, 2016 was valued at Rs.7,000.

Solution:

Question 10.

Adjustments:

Charge depreciation on Land and Building at 2½%, Plant and Machinery Account at 10% and on furniture and fixture at 10%. Make provision of 5% on debtors for doubtful debts, carry forward the following unexpired amounts:

i. Fire insurance Rs.125.

ii. Rates and taxes Rs.240.

iii. Apprentice premium Rs.400.

iv. Closing stock Rs.29,390.

Solution:

Question 11.

Closing Stock on 31st March, 2016 was Rs.1,27,410.

You are required to prepare Trading and Profit and Loss Account for the year ended 31st March, 2016 and Balance Sheet as at that date.

Adjustments to be made are:

i. Depreciate Plant and Machinery at 10% and Furniture at 5%.

ii. Raise the Provision for Doubtful Debts to Rs.15,000.

iii. Insurance includes annual premium of Rs.720 on a policy which will expire on 30th September, 2016.

iv. Purchases included a computer costing Rs.6,000.

Solution:

Question 12.

Value of Stock as on 31st March, 2016 was Rs.2,60,000. You are required to prepare his Trading and Profit and Loss Account for the year ended 31st March, 2016 and Balance Sheet as at that date after taking the following facts into account.

i. Plant and Fixtures are to be depreciated by 10%.

ii. Salaries outstanding on 31st March, 2016 amounted to Rs.35,000.

iii. Accrued interest on investment amounted to Rs.7,500.

iv. Rs.5,000 are Bad Debts and a Provision for Doubtful Debts is to be created at 5% of balance of debtors

Solution:

Question 13.

Solution:

Question 14.

Solution:

Question 15.

Solution:

Question 16.

Solution:

Question 17.

Solution:

Question 18.

Taking into account the following adjustments, prepare Trading and Profit and Loss Account and Balance Sheet as at 31st March, 2016:

a. Depreciation 5% on Plant and Machinery and 10% on Fixtures and Fittings.

b. Provision for Doubtful Debts 2½ % on Sundry Debtors.

c. Rent Outstanding for March, 2016 Rs.150.

d. Insurance unexpired on 31st. March, 2016 Rs.70.

e. Outstanding Wages and Salaries Rs.800 and Rs.350.

f. Stock on 31st March, 2016 Rs.16,580.

Solution:

Question 19.

i. Salaries Rs.100 and Taxes Rs.200 are outstanding but Insurance Rs.50 is prepaid.

ii. Commission Rs.100 received in advance for the next year.

iii. Interest Rs.210 is to be received on Deposits and Interest on Bank Overdraft Rs.300 is to be paid.

iv. Provision for Doubtful Debts to be maintained at Rs.1,000.

v. Depreciate Furniture by 10%.

vi. Stock on 31st March, 2016 is Rs.4,500.

vii. A fire occurred on 1st April, 2016 destroying goods costing Rs.1,000.

Solution:

Question 20.

Solution:

Question 21.

Stock on 31st March, 2014 is Rs.20,600.

You are to make Provisions in respect of the following:

a. Depredate Machinery at 10% p.a.

b. Make a Provision @ 5% for Doubtful Debts.

c. Provide 2½% discount on debtors.

d. Rent and Rates include rent deposit of Rs.400.

e. Insurance Prepaid Rs.120.

Solution:

Question 22.

Following is the Trial Balance of Krishan on 31st March. 2016. Prepare Trading and Loss A/c and Balance Sheet after making the following adjustments:

i. Value of closing stock Rs.29,638.

ii. Depreciate plant and machinery 10%, furniture 5%, delivery van Rs.4,000.

iii. Provide 5% for doubtful debts on debtors.

iv. Prepaid expenses: Insurance Rs.300 and taxes Rs.190.

v. 3/5 of insurance and taxes, rent and general expenses to be charged to factory balance to the office.

vi. Commission to Manager at 10% on net profit.

Solution:

Question 23.

Following adjustments are to be made:

i. Stock in Hand on 31st March, 2016 was Rs.3,250.

ii. Depreciate Building at 5% and Furniture at 10%. Loose Tools are revalued at Rs.5,000 at the end of the year.

iii. Salaries Rs.300 and taxes Rs.120 are outstanding.

iv. Insurance amounting Rs.100 is prepaid.

v. Write off a further Rs.100 as Bad Debts and Provision for Doubtful Debts is to be made equal to 5% on Sundry Debtors.

vi. Half of the stationery was used by A for his personal purposes.

Solution:

Question 24.

Solution:

Question 25.

Solution:

Question 26.

Solution:

Question 27.

Solution:

Question 28.

Solution:

Question 29.

Adjustments:

i. Stock on 31st March, 2016 was valued at Rs.5,30,000.

ii. Salaries have been paid so far for 11months only.

iii. Unexpired insurance included in the figure of Rs.4,000 appearing in the Trail Balance is Rs.1,000.

iv. Commission earned but not yet received amounted to Rs.1,220 is to be recorded in the books of account.

v. Provision for doubtful debts is to be brought up to 3% of sundry debtors.

vi. Manager is to be allowed a commission of 10% of net profit after charging such commission.

vii. Furniture is depreciated @10% p.a.

Prepare Trading and Profit and loss account for the year ended 31st March, 2016 and balance Sheet as at that date.

Solution:

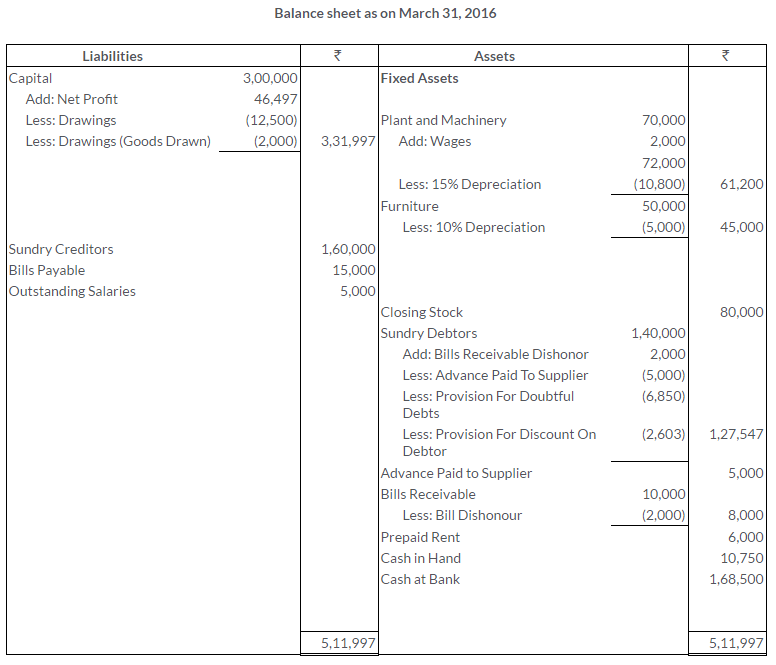

Question 30.

Additional Information :

Errors:

a. Purchases include sales return of Rs.5,000 and sales include purchases return of Rs.4,000.

b. Goods withdrawn by the proprietor for own consumption Rs.2,000 were included in purchases.

c. Wages paid for installation of plant and machinery amounted to Rs.2,000 were included in wages account.

d. Free samples distributed for publicity costing Rs.2,500, but not recorded in the books.

e. An advance of Rs.5,000 to a supplier was wrongly included in the list of sundry debtors.

f. A dishonoured bill receivable for Rs.2,000 returned by the bank with whom it had been discounted, had been credited to bank account and debited to bills receivable account.

Adjustment:

a. Charge depreciation on plant and machinery at 15% and on furniture at 10%.

b. Create a Provision for Doubtful Debts @5% and provision for discount on debtors at 2%.

c. Closing stock is valued at Rs.80,000.

Solution: